HNA closed on 17 Columbus Courtyard last week

China’s HNA Group continued to expand globally this month by closing on a ₤140 million acquisition of 17 Columbus Courtyard, a building on London’s Canary Wharf.

The purchase of the 195,443 square foot (18,157 square metre) grade A office block was announced to the Hong Kong stock exchange last week by HNA International Investment Holdings, the Hong Kong-listed subsidiary of the group that controls mainland carrier Hainan Airlines.

HNA’s closing on 17 Columbus Courtyard, which is wholly let to an international investment bank, comes just under four months after the Chinese conglomerate’s agreement to purchase the Colonnade, a building a few steps down Canary Wharf which serves as the global headquarters for Reuters news agency.

The mainland parent transportation and investment player also grabbed headlines in February by acquiring US technology distributor Ingram Micro for $6 billion, in what appears to be part of a growing list of acquisitions by the privately controlled group.

Chinese Like London’s Canary Wharf

Greenland’s Hertsmere House is planned to rise 67-storeys above London’s Canary Wharf

Under the terms of the sale and purchase agreement disclosed to the stock exchange, HNA acquired the property on Canary Wharf from Fourteen Ninety Two Limited, a subsidiary of German real estate investment firm KanAm Grund Group, for ₤9 million less than the property’s ₤140 million valuation.

The deal between KanAm and HNA was first announced in September of last year, and according to sources familiar with the transaction, property consultancy Knight Frank’s London office represented KanAm Grund on the asset disposal, while the group’s Asian operation introduced HNA as the buyer.

Shanghai-based developer Greenland Group also is planning a presence in the financial centre, after winning permission in February to build a 67-storey residential tower on Canary Wharf’s West India Quay.

HNA Continues Acquisition Streak

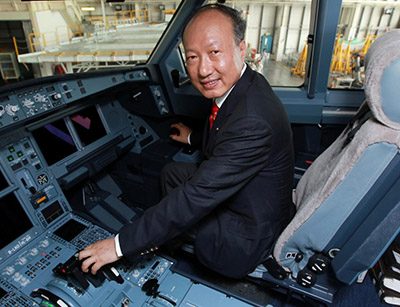

HNA chairman Chen Feng’s list of acquisitions seems to be taking off

While dwarfed by the Ingram Micro deal, HNA’s acquisition of the London office building is part of a string of recent purchases by the Chinese conglomerate, both domestically and overseas.

Earlier this month the company founded by “Buddhist billionaire” Chen Feng, agreed to acquire a 66 percent stake in Hong Kong-listed developer Tysan from Blackstone Group for HK$2.62 billion ($337 million) , expanding HNA existing property portfolio in Greater China.

In Europe, HNA last year agreed to buy airport luggage handler Swissport International from PAI Partners SAS for 2.73 billion Swiss francs ($2.81 billion) – a deal which was concluded in February.

Also last year, HNA was rumoured to be among the suitors for Starwood Hotels and Resorts, before Marriott eventually acquired the hospitality group for $13.6 billion, following a back-and-forth battle with China’s Anbang Insurance.

A rice bowl too far?