HNA is said to be buying the 1990-vintage building from CBRE GI for $360 mil

HNA Group is reportedly acquiring a 50-storey Chicago office tower for nearly $360 million as the mainland conglomerate adds to its tally of more than $14 billion in US acquisitions over the past year.

An HNA affiliate has agreed to buy the 937,000 square foot (87,000 square metre) building at 181 W Madison Street in Chicago’s famed Loop business district from CBRE Global Investors, according to a story published yesterday in Crain’s Chicago Business.

While this is the first Chicago deal for HNA, it is part of growing streak of US acquisitions for the company, which now includes agreeing to acquire a majority stake in an investment firm belonging to Anthony Scaramucci, a top advisor to new US president Donald Trump.

Biggest Chinese Deal in Chicago to Date

The HNA deal is the biggest Chinese investment in Chicago real estate to date, surpassing the $302 million that Cindat Capital Management paid to acquire 311 S Wacker Drive in March 2014. Another mainland mega-investor, Dalian Wanda Group, is developing what is slated to be Chicago’s third-tallest tower, in a project that the company predicts will be worth $900 million.

The Madison Street sale should bring CBRE Global Investors $48 million more for the Cesar Pelli-designed building than the investment management firm had paid when it acquired the 27-year-old structure for just under $400 million in October 2013. CBRE GI had engaged brokerage Eastdil Secured to market the building in late 2015, according to the Crain’s report, with an initial asking price of $400 million.

HNA Buys Up US Property, Looks for More

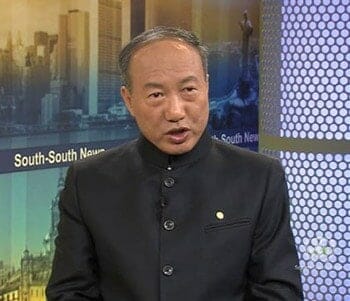

$14 bil in US deals may not be enough for HNA’s Chen Feng

The $360 million Chicago deal follows major real estate acquisitions by HNA in Seattle, San Francisco, and Minneapolis last year. Also during 2016, the parent company of China’s Hainan Airlines bought tech company Ingram Micro for $6 billion, picked up a stake in the Hilton Hotel group from Blackstone for $6.5 billion, and bought out Minnesota-based Carlson Hotels for a price estimated to approach $2 billion.

In all, the mainland firm has acquired more than $14 billion in US assets in the past 12 months, while also acquiring more than $2.5 billion in Hong Kong real estate during the last three months.

Among the highest profile of HNA’s US deals is the company’s agreement last month to team with RON Transatlantic EG to acquire a majority stake in SkyBridge Capital, the investment firm founded by incoming White House adviser Anthony Scaramucci, for an undisclosed sum. Political and industry analysts have speculated that the move by HNA, which is controlled by mainland billionaire Chen Feng, is motivated by a desire to cultivate connections with the incoming administration that could protect its current deals and facilitate new ones.

And, according to a China-based financier familiar with HNA’s strategy, the mainland heavyweight may just be getting started. “HNA has a cash-generating airline and numerous other businesses, so I don’t think the company sees $14 billion in acquisitions as unreasonable or unmanageable, Brock Silvers, founder of Shanghai-based private equity firm Kaiyuan Capital and a long-time associate of superinvestor Sam Zell, told Mingtiandi.

Capital Controls Haven’t Hit Chicago Deal

While deals such as Chem China’s $43 billion attempted takeover of Switzerland’s Syngenta appear to have stumbled over China’s clampdown on capital outflows, the new directives may have less of an impact on HNA’s Chicago acquisition or on other similar deals.

“The new rules aren’t meant to prevent established corporates from making offshore growth investments, but rather to dissuade speculation and money laundering,” Silvers told Mingtiandi. “Companies investing less than $1 billion to expand existing businesses should still be able to close deals, and in China it will take more than a middling provincial bureaucrat to reject a major dealmaker like HNA’s Chen Feng or Anbang’s Wu Xiaohui.”

The new guidelines stipulate that any acquisitions of overseas assets of more than $10 billion in value by Chinese firms must first gain approval from China’s Ministry of Commerce as well as from top planning body the NDRC. Many deals of over $1 billion are also said to require vetting by the two agencies.

Despite the clampdown, the coming year could see additional deals by the mainland conglomerate. “HNA is looking to do considerably more, and I see the company closing further deals in 2017,” Silvers predicted.

Leave a Reply