China Orient Asset Management is buying a 49% stake in RXR’s 61 Broadway

One of China’s state-backed “bad asset banks” paid $216 million last week for a 49 percent stake in a historic New York skyscraper, as Chinese investors continue to acquire New York properties.

China Orient Asset Management (International), a Hong Kong-based subsidiary of Beijing’s China Orient Asset Management, closed on an agreement last week with New York-based RXR Realty to purchase the stake in 61 Broadway, a 33-storey building in Manhattan’s financial district, according to a report in the Commercial Observer.

Simultaneously with the closing on the purchase agreement between the US real estate investment firm and the mainland financial group, the owners of the building secured a $290 million mortgage from the Bank of China and New York’s SL Green Realty Corp.

Arranging Refinancing for Historic NYC Tower

China Orient, which was formed in 1999 to take over the bad loans of Bank of China, and maintains a close relationship with the big four Chinese lender, appears to be leveraging its access to low cost financing in China to help make deals happen in the US. Of the $290 million in new financing for the 1914-vintage tower, $240 million is said to have come from Bank of China, with SL Green supplying the remaining $50 million.

Roy Chen says the deal with RXR fits China Orient’s value-add strategy

“This investment is consistent with our US real estate investment strategy, which has been to acquire value add assets in partnership with sophisticated and institutional US operators,” Roy Chen, managing director and head of US real estate for China Orient Asset Management (International) said regarding the deal.

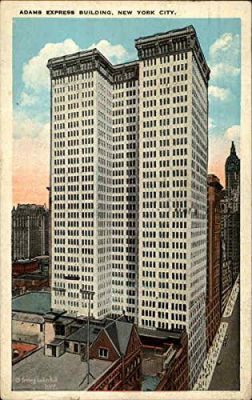

RXR originally purchased the tower, which was originally known as the Adams Express building, in May 2014 for $330 million, and had since spent some $8 million upgrading elevators, fire control, HVAC and other elements of the property, according to its website.

This latest transaction is puts a gross valuation of $440 million on the 787,000 square foot (73,114 square metre) edifice at the corner of Broadway and Exchange street in New York, and the new financing replaces a $200 million loan from HSBC that RXR had used to finance its earlier acquisition.

China Orient and RXR reportedly signed an initial agreement for the investment in December last year, with JLL’s New York investment team brokering the transaction.

China Orient Following Cinda’s Lead into US Real Estate Market

A postcard of the Adams Express building “back in the day”

Although China Orient is one of China’s four asset management giants, prior to this transaction it has taken an incremental approach to entering the US real estate market.

China Orient’s state-run asset management counterpart China Cinda Asset Management has used its private equity affiliate, China Cindat Capital Management to invest in headline acquisitions such as the $304 million acquisition of 311 South Wacker Drive in Chicago in 2014.

Also in 2014, Cindat Capital joined with China Vanke and Hines to invest in a residential development at 610 Lexington Avenue in Manhattan, and more recently has been investing in development projects in New York such as 565 Broome Street in New York’s SoHO area.

China Orient, by contrast has preferred to take minority stakes in finished projects with potential for upgrade, and until now had largely avoided the spotlight.

Leave a Reply