While cosmopolitan gateway cities have dominated the headlines about China’s wave of outbound investment in property, a distinctly middle-American metropolis beat out London by 33 percent and smoked Sydney by 91 percent in the race to attract Chinese capital during the first quarter of 2014.

Helped along by the $304 million acquisition of the 65-storey 311 South Wacker Drive office building by China’s Cindat Capital Management and Chicago-based Zeller Realty Group, Chicago led all other cities for Chinese real estate investment in the first three months of this year.

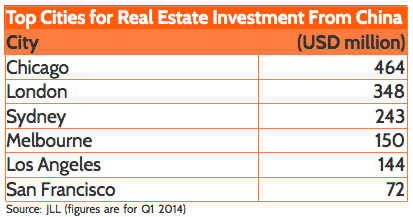

According to recent figures from real estate consultancy JLL, the city with broad shoulders brought in a total of US$464 million in Chinese capital during the period, while London managed $348 million, and Sydney trailed with $243 million.

Gateway Cities Continue to Dominate

Overall, however, the JLL research found that “global gateway” cities such as London, Sydney, Melbourne, Los Angeles and San Francisco accounted for 67 percent of the capital invested in the top six cities during the period. The agency’s figures did not include mention of New York, and did not specify a method for counting the total capital invested in each city. The comparison also did not specify if the $304 million 311 South Wacker Drive acquisition, which was a joint project between US and Chinese partners, was counted entirely as a Chinese investment in terms of the acquisition value.

During the first quarter, growth in investment in commercial real estate was seen as flat compared to the same period of 2013, with Chinese investors acquiring approximately US$1 billion in assets. The office sector continued to dominate “as the preferred asset class among Chinese commercial real estate investors” according to a statement from the company.

In terms of a race between nations, in terms of overall investment (including residential projects), the US and Australian real estate markets attracted most of this capital from China from January through the end of March, with the United States bringing in US$732 million and Australia with US$400 million during the first quarter.

China to Break the US$10 Billion Barrier

The property brokerage, which has seldom been noted for its pessimism on the market, sees growth in Chinese outbound investment in real estate continuing this year.

Darren Xia, Director of JLL China’s International Capital Group predicted, “We expect interest and activity from equity-rich Chinese investors in overseas real estate markets to continue to grow throughout the remainder of 2014 and, as a result, it is possible that the total volume of spend by Chinese investors on commercial real estate outside of China could pass the USD 10 billion mark in 2014.”

So maybe now is the right time to take another look at that bungalow in Oak Park or a condo along the Loop.

Leave a Reply