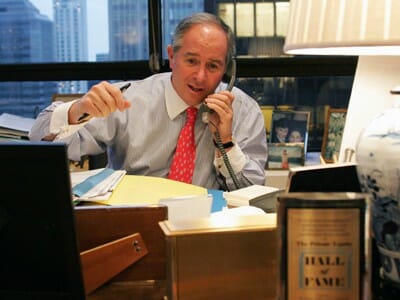

Stephen Schwarzman’s China deals seem to have given him a direct line to mainland investors

What’s another $250 million to a billionaire? Probably not much, but it still wasn’t a bad five days at the office for Blackstone boss Stephen Schwarzman whose net worth jumped a quarter of a billion dollars last week thanks to his investment firm’s flurry of deals with Chinese buyers. to $10.2 billion last week.

A four percent rise in the price of Blackstone’s stock meant the company’s CEO and chairman’s personal fortune climbed to $10.2 billion by the time the bell sounded on Friday. And this jump in Blackstone’s share value came just after Blackstone sold a 25 percent stake in Hilton Worldwide Holdings to China’s HNA Group last week for $6.5 billion.

Blackstone had purchased the hotel chain in 2007 for $26 million before staging a successful $2.35 billion IPO of the company six years later. The transaction will see the New York-based firm’s stake in Hilton reduced to 21 percent.

For Blackstone, the sale of the stake in Hilton was the latest transaction involving a Chinese buyer. Together with its portfolio companies, the private-equity real-estate firm has sold an estimated $16 billion in hotels, office buildings and other overseas real estate assets to Chinese buyers, according to data compiled by Dealogic and The Wall Street Journal.

“As the second largest economy in the world, it’s no surprise that China is making more outbound investments,” Christine Anderson, spokeswoman for Blackstone, explained to the newspaper. “Given the nature of our business and quality of the assets we own, it’s also no surprise that they would be acquiring from us.”

Anbang Insurance Can’t Get Enough Blackstone Assets

Anbang’s Wu Xiaohui and Blackstone chief Stephen Schwarzman continue to do business together

While the friendship between Schwarzman and Anbang boss Wu Xiaohui is no secret, the pair have done a staggering amount of business together during the past two years. The deal-stream started out with the mainland insurer’s much-hyped purchased of the Waldorf Astoria in New York City from Blackstone-controlled Hilton Hotels and Resorts for $1.95 billion.

Wu’s mainland money machine got its first taste of hospitality real estate from Blackstone in the Waldorf Astoria deal and went back for seconds when it acquired Strategic Hotels & Resort, a portfolio of 15 hotels, from a real estate fund managed by Schwarzman’s outfit for $6.5 billion.

Most recently, Anbang is said to be acquiring $558 million worth of office properties in the Netherlands from Blackstone. Should the deal be completed the total value of property assets sold by the alternative investment giant to the controversial mainland insurer will surpass the $9 billion mark.

Of course, the relationship between Blackstone and Anbang hasn’t been without its hiccups. An advisory firm partly owned by Blackstone also worked with Anbang on its disastrous attempt to buy Starwood Hotels & Resorts for $13.2 billion earlier this year. The two were also unable to come to an agreement on the 16th hotel in the Strategic portfolio, the $1 billion Hotel del Coronado in Southern California, after concerns were raised by U.S. national-security officials regarding the deal.

Is India Blackstone’s Next Play?

While Blackstone has been selling US assets to the Chinese, the US firm continues to quietly acquire assets in India and is now the largest owner of office real estate in the country.

Schwarzman’s organization is said to be planning to list two separate REITs in India. It is collaborating with local firm Panchshil Realty for its office assets in the National Capital Region and western part of the country. Additionally, Blackstone is rumored to be partnering with Bengaluru-based Embassy Property for an office REIT focused on southern India.

And it is not just office assets being gobbled up. In early October, the firm purchased a mall in southern India’s Tamil Nadu state from a local developer for $67.5 million. Later last month, it acquired Westend Mall in Pune for $59.9 million. Blackstone’s retail portfolio in India now boasts five malls with 3.4 million square feet (315,870 square metres).

Leave a Reply