Anbang could soon own a lot of tatami and paper walls in Japan if its deal with Blackstone goes through

Some buyers search far and wide looking for the best deal while others simply find a business they like and commit to them for years regardless of if there are bargains to be had elsewhere. It’s safe to say Anbang Insurance’s relationship with Blackstone falls in the latter category.

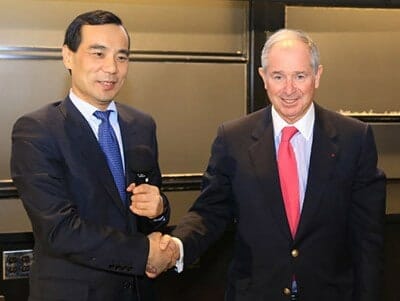

Anbang Chairman Wu Xiaohui and Blackstone CEO Stephen Schwarzman look set to do business with each other once again as Reuters is reporting the mainland insurer is in talks with the alternative investment giant to buy as much as $2.3 billion in Japanese residential property assets.

The deal would be historic on many levels if completed. It would mark Anbang’s entrance into the Japanese market after losing out on its $1 billion bid to acquire Japanese real estate asset manager Simplex Investment Advisors last year. It would also be the largest property transaction in Japan since 2007 and could be interpreted as another sign that the property market in the country has rebounded.

Sources close to the deal told the news agency said that Anbang would acquire apartment buildings aimed at middle-class residents. The transaction includes properties in Tokyo, Nagoya and Osaka that Blackstone purchased from General Electric for JPY 190 billion ($1.7 billion) in 2014.

Blackstone Rakes In $11B From Anbang In Two Years

Here’s a familiar sight, Anbang chairman Wu Xiaohui and Blackstone’s Stephen Schwarzman making a deal

At the current rate the mainland firm is buying, Blackstone could soon run out of assets to sell. Should the deal be consummated, the sale of the Japanese housing portfolio would bring the total amount of real estate Anbang has purchased from Schwarzman ‘s firm to more than $11 billion.

However, the relationship between the two continues to evolve. The first deal between America’s biggest landlord and the upstart mainland insurer was the $1.95 billion sale of the Waldorf Astoria hotel in New York, which was seen as a trophy asset that would establish Anbang as a global player.

The second deal between Boss Wu and Schwarzman’s Blackstone was the $6.5 billion sale of the Strategic Hotels & Resort portfolio, which also featured a number of trophy assets, including the InterContinental Hotel in Chicago.

The pair’s most recent transaction was far less glamorous, with Anbang picking up $558 million worth of office properties in the Netherlands from the New York-based firm.

About That Overseas Buying Pause

This latest acquisition appears to contravene recent statements by Anbang that is would slow down its deal pace.

In September the insurer’s vice chairman, Yao Dafeng, revealed that the company was going to step back from making international acquisitions while it integrated its latest purchases. The revelation came a few months after news broke that the China Insurance Regulatory Commission (CIRC), which regulates the insurance industry on the mainland, was reportedly assembling a team to investigate the trophy-hunting outfit.

The words from Yao have disappeared as fast as dumplings at a dim sum buffet, as Anbang has made more than $3 billion worth of overseas purchases since Yao made his policy statement. The firm’s most recent deal came last week when it was said to be close to an agreement to buy a 30-storey office and retail tower in downtown Toronto for C$530 million ($395 million).

Mainland Buyers Gobble Up Nearly $20B Of Assets From Blackstone

While Anbang is no doubt Blackstone’s most frequent customer, it is not the only mainland firm to turn to the alternative investment player in search of overseas assets. In fact, the most recent deal would bring Blackstone’s total sales of assets to Chinese firms to more than $19.8 billion since the beginning of 2015.

And it’s not just Schwarzman who is hard at work. Blackstone’s global head of real estate Jonathan Gray was instrumental in the firm’s selling of a 25 percent stake in Hilton Worldwide Holdings to China’s HNA Group for $6.5 billion in October.

It was Dalian Wanda that jump-started the Blackstone buying frenzy way back in January of 2015. The Beijing-based mall developer bought the Gold Fields House office block along Sydney’s Circular Quay from Blackstone for A$415 million ($329 million).

Leave a Reply