After developing an industrial portfolio in the US, the Dongguan project will be Hines first China logistics venture

US-based developer Hines and a Carlyle Group-backed real estate fund manager have joined forces to acquire a 33,800 square metre (363,820 square foot) cold storage facility and adjacent development site in southern China’s Guangdong province.

The property is in Dongguan’s Shatian district, a logistics hub for the Pearl River Delta urban corridor comprising nine mainland cities plus Hong Kong and Macau. Hines and its partner, Metropolitan Real Estate Equity Management, plan to build an additional multi-storey cold storage complex on the adjacent site.

“We are pleased to partner with Metropolitan on this opportunity,” said Hines Asia Pacific managing director Claire Cormier Thielke. “The population growth, policy support and connectivity of the Greater Bay Area create a compelling story for both general and specialised logistics. We are enthusiastic about the fundamentals of cold storage and the pursuit of transactions in this space as demand grows in a post-COVID environment.”

Building on a China Footprint

The refrigerated warehouse investment will be Hines first logistics project in China after the developer opened its first office in the country in 1996. It has since amassed developments, acquisitions and operations totalling over 14 million square feet (1.3 million square metres) across Beijing, Shanghai and Dalian. Globally, Hines has $144.1 billion in assets under management.

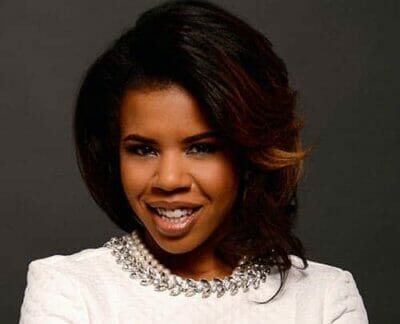

Hines managing director Claire Cormier Thielke

Metropolitan Real Estate, part of the Carlyle Group’s investment solutions business, is a private equity investment platform encompassing primary fund investments, direct property co-investments and secondaries. Carlyle is a NASDAQ-traded global investment firm with $221 billion in assets under management as of June 2020.

“We are very pleased to partner with Hines on a project which we believe will be an integral asset in the cold chain infrastructure in the Greater Bay Area,” said Metropolitan managing director John So.

Asia Pacific Ice Capades

The Hines-led Dongguan transaction is part of a cold chain trend identified by Colliers International as a major new growth driver in logistics. Logistics clusters in Asia Pacific with a high stock of cold chain warehouses include Singapore (10 percent of total stock) and West China (15 percent), with the latter market concentrated in Chengdu, according to a report on APAC logistics released by the real estate services firm in October.

“Looking forward, we expect that high-volume purpose-built cold chain warehouses will be built near ports and transport hubs, while renovated cold chain warehouses will be located closer to cities for easier distribution,” Colliers said. “Purpose-built warehouses cannot be too small, or construction will not make economic sense. Conversely, renovated warehouses can be as small as 6,000 square metres.”

A key driver of cold chain growth is fresh food ordered online, a segment in which delivery volumes are rising 100-200 percent year-on-year in certain markets, the report said.

The pharmaceutical sector also needs cold chain facilities, and storage requirements have taken on a new urgency as drugmakers race to develop a COVID-19 vaccine. The two front-running candidates, made by Moderna and Pfizer, must be kept at -20C and -70C (-4F and -94F), respectively, to prevent a breakdown of the vaccine material, posing a formidable distribution challenge.

Stuart Ross, head of industrial for Southeast Asia at JLL, who previously led the property consultancy’s industrial team in China, sees the vaccine news giving a boost to cold chain expansion.

“Absolutely, COVID-19 is accelerating demand in what was already an undersupplied market for cold storage,” Ross said. Cold chain transport, the movement of temperature-sensitive goods in a controlled environment from one facility to another, is another key component with plenty of room for development, he said.

And while APAC may be less far along in its cold chain evolution than North America and Europe, Ross expects maturing Asian markets to see rapid growth in cold chain logistics as they look to reduce food spoilage in transit. The veteran industrial broker cites China, Vietnam, Indonesia and India as large markets ready to springboard from a low base in the cold chain field.

Cold Cash Considerations

Rental premiums are helping to drive interest in cold storage investments as yields compress in an increasingly crowded logistics market. In Singapore, which hosts about 457,000 square metres of refrigerated warehouse space, cold storage rents can be 100-200 percent higher than dry warehouse rents, according to Colliers estimates.

Labour and utilities are two of the biggest expenses in cold storage, and automation is not as widely used as in other segments, JLL said in a September report on cold storage in the post-COVID economy. Complexity in design, increased demand and renovation of older warehouses to accommodate cold storage are other contributors to surging rents.

From a tenant’s perspective, cost per pallet is one of the primary drivers when choosing a cold storage warehouse, JLL said. Cold storage tenants prefer ceiling heights of 40 to 50 feet (12 to 15 metres), as well as appropriate spacing to maximise stacking and racking of goods.

Investing in a new space — as Hines is doing at the Dongguan site — is often the best way to achieve the needed specifications, according to JLL’s research.

Leave a Reply