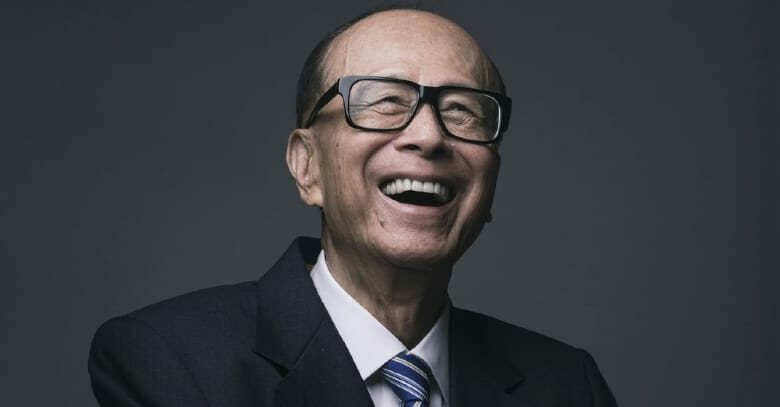

Li Ka-shing can celebrate another year at the top

Six property multibillionaires among the richest Hong Kongers remain unfazed by pandemic headwinds, with their $142.2 billion in cumulative wealth accounting for as much as 72 percent of the total fortunes of the city’s top 10, according to Forbes’ latest tally.

While real estate magnates Li Ka-Shing, Lee Shau Kee and Henry Cheng retained their spots as the city’s three wealthiest individuals for a second consecutive year in 2021, Hong Kong rich-listers who strayed beyond the city’s traditional source of wealth found their fortunes under fire.

Casino magnate Lui Che Woo, who finished eighth with a fortune of $12.8 billion, Alibaba’s Joseph Tsai, who took the ninth spot with $9.1 billion in holdings, and Yeung Kin-man, who along with his wife controls screen maker Biel Crystal and finished 10th with $10.9 billion in estimated assets, all saw double-digit drops in their wealth last year.

Developers Enjoyed Stock Pop

Benefiting from the uptick in Hong Kong’s housing market last year was CK Hutchison founder Li Ka-Shing, whose shares in flagship company CK Asset Holding shot up 30 percent from 2020’s record. The 93-year-old patriarch is holding onto the crown as Hong Kong’s richest person for the second year with a personal fortune of $36 billion, up 2 percent from the previous year.

Peter Woo of Wheelock and Wharf saw his assets grow by $1.7 bil

Second-ranked Lee Shau Kee of Henderson Land saw his net worth grow 12 percent in 2021 to $34.2 billion as the group’s underlying profit attributable to shareholders during the first half of 2021 more than doubled from HK$2.8 billion in 2020 to HK$6.5 billion.

Last year, Peter Woo of Wharf Holdings, a high-profile homebuilder, was able to reap an additional $1.7 billion, as his total assets grew to $18 billion. The tycoon’s rank jumped from seventh to fifth as his fortunes grew by 10 percent just a year after his wealth surged following the privatisation of his once-listed Wheelock & Company in 2020.

Bonanza From Diversified Assets

Though HKEX-listed blue-chip developer New World Development saw its revenue dip marginally by 0.01 percent in the second half of 2021, the net worth of Henry Cheng, the second-generation chairman of the group (No.3, $26.4 billion), rose by 19 percent thanks to a 40 percent surge in sales at the family’s Chow Tai Fook jewellery empire last year.

In that same period, Chan Tan Ching-fen — widow of the late founder of Hang Lung Group, Chan Tseng-hsi, and the biggest shareholder in the group which controls Hang Lung Properties — has become the second-richest woman in Hong Kong with her personal wealth soaring up to 105 percent. Climbing 14 places from 39th to the 25th spot on the list, Chan’s net worth of $3.9 billion was fuelled by heaps of cash that she personally raised from TikTok’s arch-rival Kuaishou Technology — which successfully completed its IPO last year.

Taking the Bullets

Now ranked as Hong Kong’s sixth-wealthiest billionaire, Chinese Estates’ Joseph Lau was able to steer clear of any dent in his net worth ($13.7 billion) despite his firm posting a loss of HK$7.9 billion ($1 billion) — its biggest in a decade — after dumping its shares in the world’s most-indebted developer, China Evergrande.

While that disposal knocked a third off of Chinese Estates’ value, Lau, who held the eighth position in Forbes’ 2020 Hong Kong Rich List, gained $200 million in windfall profits from his privately held assets in one of the world’s most expensive cities, including Chinese Estates’ headquarters in Causeway Bay, Forbes said in a separate report.

Taking a hit from his shareholding in one of China’s largest developers was Guangzhou R&F Properties chairman Li Sze Lim, who saw his personal fortune shrink by 37 percent from $2.75 billion to $1.73 billion last year, as the Guangdong-based builder saw its stock price drop more than 70 percent during 2021.

Leave a Reply