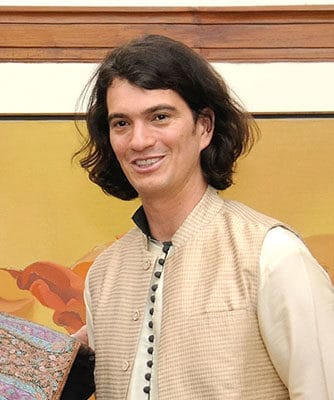

WeWork CEO Adam Neumann seems ready to do just about anything to establish his India presence

US co-working unicorn WeWork is planning to take majority control of its India affiliate in a deal worth $1.9 billion which would allow the shared-office operator to consolidate its operations, and its financial results, in preparation for an initial public offering this year, according to a Bloomberg report.

The New York-based company is said to be in talks to buy around 70 percent of WeWork India, at a valuation of about $2.75 billion. The deal, worth $1.9 billion at those terms, would be part cash and part stock, and could close as early as August, reported the news agency, citing an unnamed source.

WeWork India is currently owned by billionaire property developer Jitu Virwani of Embassy Group through a licensing deal that ends in June 2021. According to the local media, Embassy, which holds an 80 percent stake in the franchise, has so far invested $150 million in building the WeWork brand in India, after paying $200 million for the operating rights two years ago.

Paying to Buy Back Fast-Growing India Operation

Led by Virwani’s son Karan Virwani, WeWork India has grown faster than originally envisaged, with a total of 35,000 desks now spread across 20 locations in Bengaluru, Mumbai and the country’s National Capital Region. The shared office provider hosts companies such as Microsoft and Amazon in Bangalore, and Spotify Technology and Bumble in Mumbai.

Embassy plans to expand the franchise to 90,000 desks by December this year, a target originally scheduled for 2021. Should that goal be met, with an average monthly rental of Rs 15,000 ($215) to Rs 18,000 ($257) for each desk, the country’s leading office space developer could be looking at a gross revenue of around Rs 1,500 crore ($214 million) for its WeWork franchise this calendar year.

With some of the recent investment deals in the flexible office sector being made at valuations of eight to 15 times gross billings, according to local media reports, WeWork was said to be seeking ownership of the Indian unit before its valuation climbs out of reach.

Consolidating in Run-Up to IPO

WeWork India has caught on with customers from all walks of life

Softbank-backed WeWork revealed in April that it had filed for an initial public offering in December last year despite recording a loss of $1.9 billion in 2018.

Founded in 2010, the co-working pioneer was valued at $47 billion in its latest fund raising in November last year when its largest shareholder, Softbank, committed another $3 billion to the company.

While WeWork reshaped office practices around the world with its trendy work areas, colourful phone booth-like conversation areas and lively community hangouts serving beer on tap, the shared-office operator has yet to prove it can make money.

The company’s business model continued to rely heavily on funding from private investors, with Softbank having poured over $10 billion into the company, including $2 billion this year.

In April, WeWork was reported to have pulled out of at least five negotiations to take on new space in Hong Kong this year after failing to get budget approval.

The company has also faced questions of conflict of interest as it approaches its public listing. Last month WeWork announced the formation of a real estate investment and management platform backed by Canadian fund manager Ivanhoe Cambridge, which functions in part to buy out properties currently leased to WeWork where CEO Adam Neumann is understood to be an investor.

Leave a Reply