UEL’s UE Bizhub Tower at 79 Anson Road in Singapore

Shanghai-based Yanlord Land Group is making a mandatory cash offer for United Engineers Limited in a deal that values the century-old property company at S$1.7 billion ($1.25 billion).

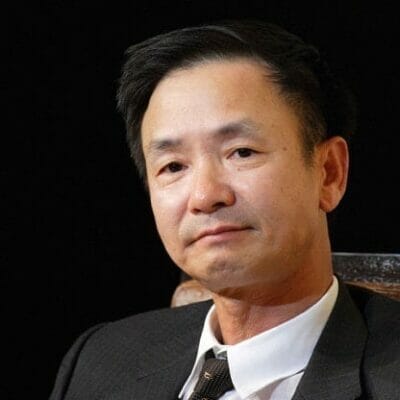

The developer chaired by mainland native Zhong Sheng Jian, who is also the executive chairman of UEL, is offering S$2.60 in cash per share for the 65 percent of the ordinary shares and three percent of the preference shares it does not already own in the Singapore-listed company.

“We are happy to increase our stake in United Engineers as we are patient investors and believe in the long-term prospects of the businesses,” Yanlord chairman and chief executive officers Zhong Sheng Jian said in a statement. Yanlord said that it does not intend to delist or privatise the company.

UEL’s share price closed on Friday at S$2.62 after the company had called a trading halt on 22 October.

Yanlord entered the Singapore property market only last year when it teamed up with a Hong Kong Land affiliate to snap up a prime en bloc site for S$906.9 million.

Yanlord Buys Out JV Partners

Yanlord’s general offer of S$2.60 each for the outstanding shares in United Engineers, which owns a portfolio of shopping malls, commercial developments and hospitality properties in Singapore and mainland China, was triggered after the mainland developer became the largest shareholder in the target firm — with a 35.27 percent stake — through a separate S$229.7 million buyout of its partners in a joint venture.

Yanlord Land formed that JV, Yanlord Investment (Singapore) Pte. Ltd, in 2017, together with Perennial Real Estate Holdings and Heng Yue Holdings, as the three companies made a joint bid to buy out United Engineers at a $1.4 billion valuation — the same value being used for this renewed offer.

In that earlier bid, the trio succeeded in acquiring just over one third of United Engineers from local finance group OCBC and its affiliates, however, rival developer Oxley Holdings ultimately foiled the buyout attempt with its own purchase of a 15 percent stake in United Engineers on the open market.

Zhong Sheng Jian’s Yanlord is making a renewed offer for UEL

Now, according to a separate announcement by Yanlord Land, it has reached an agreement with Perennial and Heng Yue to acquire their stakes in Yanlord Investment. Yanlord will be paying Perennial around S$202.7 million for its 45 percent stake in the joint venture, while Heng Yue will receive just over $27 million for its 6 percent stake.

Through this buyout, Yanlord Land will rank as the largest shareholder in United Engineers, with a 35 percent stake, which triggers a mandatory offer for the outstanding shares.

“Perennial and Heng Yue had both expressed an intention to dispose of their respective stakes in the Offeror in order to focus on investments with direct value creation opportunities,” Yanlord’s chairman said in the statement. “The Acquisitions provide both parties with an avenue to exit their investments in the Offeror.”

The transaction also involves Yanlord taking sole ownership of a 29.9 percent shareholding in property development and engineering company WBL Corporation Limited, which is controlled by UEL and was delisted in 2014.

Offering an Exit to an Illiquid Investment

The mandatory cash offer launched on Friday is conditional upon obtaining acceptances from shareholders with more than 50 percent of total voting rights. If the offer fails, Yanlord will not be able to make another offer within 12 months following the lapse.

Should the offer succeed, Yanlord is required under Singapore bourse regulations to make an unconditional cash offer for the WBL Corporation shares the company does not own at S$2.59 per share.

Yanlord said that the offer for UEL was an opportunity for shareholders who may have found it difficult to exit their investment due to low trading liquidity, with the average trading volume of UEL shares over the last 12 months amounting to 0.07 percent of the total number of UEL shares.

Oxley Holds Next Largest Stake

Other major shareholders include Oxley Holdings with a 19 percent shareholding, Oxley chairman Chiat Kwong Ching with a 3.5 percent interest, and with 3.4 percent held by UEL chairman Zhong Sheng Jian.

Minority shareholders include Dimensional Fund Advisors with 2.6 percent, Morph Investments with 2.3 percent, The Vanguard Group, and See Ching Low.

Yanlord’s offer comes a year and a half after Oxley’s Chiat Kwong Ching, was reported to have faced off with the company’s directors over their refusal to give him a place on the board.

Leave a Reply