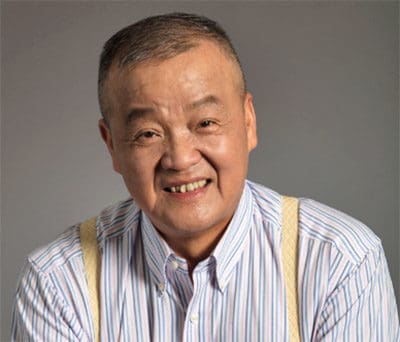

Ping An chairman Ma Mingzhe is buying more of CFLD

Chinese financial giant Ping An has increased its stake in top ten mainland builder China Fortune Land Development (CFLD) to 25.25 percent, less than seven months after it acquired nearly one fifth of the group to become its second largest shareholder.

An announcement to the Shanghai Stock Exchange by CFLD on Friday revealed that its largest shareholder, privately held China Fortune Land Holding Co Ltd, had sold 170 million shares to Ping An Asset Management, a subsidiary of Ping An Insurance Group, for RMB 24.597 per share in a deal worth just over RMB 4.2 billion.

The transaction reduces China Fortune Land Development Holding’s controlling stake in CFLD from 41.30 percent to 36.29 percent, while adding a 5.69 stake in the Beijing-based developer to the 19.56 percent holding that Ping An Insurance had acquired in July last year.

Buying into a Top 20 Developer at a Discount

Ping An is buying this latest batch of shares at a more than four percent discount off the lowest share price for CFLD over the last 30 days. The developer achieved contracted sales of RMB 163.48 billion in 2018, according to an announcement last month, an increase of 7.45 percent over its 2017 performance. The company’s stock jumped 2.16 percent on Friday to close at RMB 27.88 per share after news of the equity sale was announced.

According to the statement by CFLD, Ping An’s latest investment in the developer signifies its confidence in CFLD’s future and determination to increase CFLD’s competitiveness and earning abilities.

Following Ping An’s latest purchase, CFLD will maintain the structure of its current board, which already includes senior three Ping An executives who joined the executive team last November.

Insurer Invests for the Long Term

CFLD chairman Wang Wenxue maintains his controlling stake in the Beijing-based developer

CFLD said Ping An’s investment is for the long term. Beyond CFLD’s core specialty in building industrial townships, the two companies also will explore development opportunities in rental housing and healthcare for the elderly.

Prior to the latest transaction, CFLD had already vowed that net profit attributable shareholders will be no less than RMB 11.4 billion for 2018, with that number projected to increase to RMB 14.48 billion in 2019 and grow to RMB 18 billion for 2020.

Ping An, China’s most valuable insurer, was also the first insurer to respond to the China Banking Regulatory Commission’s call on January 28 for insurance funds to “increase holding of top public-listed companies.”

Following Up on July Commitment

Ping An’s latest investment follows its RMB 13.8 billion purchase of 582.1 million shares in CFLD in July last year. In that transaction China Fortune Land Holding Co Ltd sold the equivalent of 19.7 percent of the company to Ping An Asset Management at RMB 23.655 per share, a five percent discount to the previous closing price for the stock. That deal added to a 0.18 percent share which Ping An already held in the developer to increase its stake to just under 20 percent.

CFLD founder and CEO Wang Wenxue said last year that, armed with Ping An’s ample cash reserves and some fresh leadership from the insurer, the company aims to join the ranks of China’s top three developers, and is ready to venture beyond its traditional specialty in building industrial townships.

In 2018, CFLD was pushed out of the ranks of China’s top 10 developers by contracted sales after finishing in ninth place in 2017 as the company failed to keep pace with its rivals despite a 57.56 percent year on year increase in the number of square metres it sold.

Leave a Reply