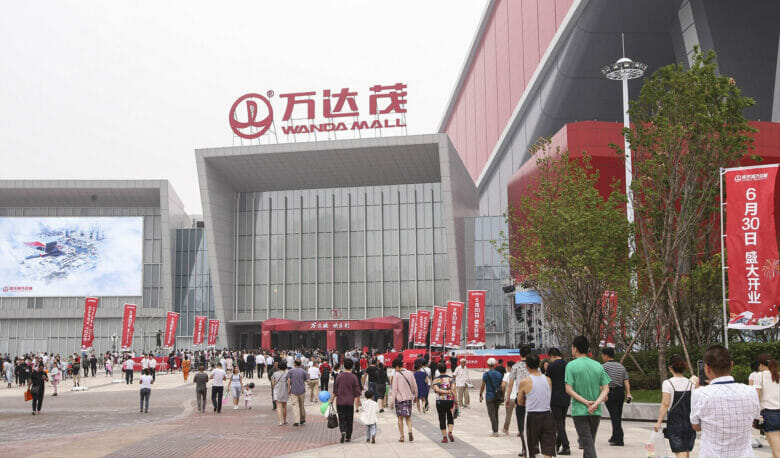

PAG is now adding some malls for its mall management firm (Getty Images)

Having already acquired the manager of the mainland’s largest mall chain, PAG is set to lead a RMB 50 billion ($6.9 billion) acquisition of 48 Wanda Plaza shopping centres in China, official records show.

The private equity firm has teamed up with tech giant Tencent Holdings, local insurer Sunshine Life Insurance, Taikang Life and a unit of e-commerce giant JD.com for the acquisition, according to documents filed with the State Administration for Market Regulation, which serves as China’s anti-trust watchdog.

PAG is currently working with banks and other lenders to finance the deal, with mainland news outlet ThePaper indicating an expected closing in the second half of the year. The buyout partners had completed paperwork for transfer of the companies holding the Wanda malls last month, according to a notice on the website of the anti-trust regulator.

The mall acquisition comes after a PAG-led consortium closed on an $8.3 billion buyout of Zhuhai Wanda Commercial Management last September with the seller in that deal, Dalian Wanda Group, which controls more than 500 malls across China, continuing to struggle financially.

Investors Old and New

Now that the State Administration for Market Regulation has approved the mall buy, PAG is rounding up commitments for a RMB 50 billion fund, with the private equity firm planning to contribute around RMB 5 billion to a subordinated tranche of the vehicle, according to an account by Bloomberg.

PAG executive chairman and co-founder Shan Weijian

The fund manager led by dealmaker Shan Weijian is seeking another RMB 30 billion from bank loans, with the remainder to come from a mezzanine facility marketed to investors.

PAG representatives declined to comment in response to inquiries from Mingtiandi, while Dalian Wanda had yet to respond by the time of publication.

The investors named in the mainland regulator’s notice represent a distinct team from the backers of PAG’s Zhuhai Wanda Commercial Management buyout, which saw CITIC Capital, the Abu Dhabi Investment Authority, Emirati sovereign fund Mubadala and US private equity firm Ares Management join the consortium which took a 60 percent stake in the mall manager.

While Newland Commercial Management, the holding company which the PAG-led group acquired to take control of Zhuhai Wanda Commercial Management last year, manages more than 500 malls, Wanda Group has developed many of these projects on behalf of third-party investors, while others have been sold or shifted into joint ventures.

Rumours of PAG interest in Wanda’s mall portfolio had been circulating for at least one year, before the deal was verified in the announcement last week.

Tencent and JD had been part of a consortium which invested RMB 34 billion to acquire a 14 percent stake in Dalian Wanda Commercial Properties from Dalian Wanda Group in 2018. That deal established Dalian Wanda Commercial Management Group as Wanda sought to transition from a property developer to a commercial management service provider.

Tencent was also part of a PAG-led consortium which in 2021 invested RMB 38 billion to take a 21.2 percent stake in Zhuhai Wanda Commercial Management.

Sunshine Life Insurance has acquired at least six Wanda Plazas in the last two years, according to local media accounts.

Struggles Continue

With Dalian Wanda ranking as China’s largest owner of malls, the company has continued to struggle as the mainland faces an ongoing shopping slump. In December Fitch Ratings downgraded the credit of two of Wanda Group’s major business units to “Restricted Default” status after the company asked creditors to give it more time to repay bonds.

Records from business information search platform Qcc.com show that Dalian Wanda Group has been the target of a number of asset freezes in the past few months as creditors attempt to collect on debt. In March a court in Zhengzhou froze Dalian Wanda Group’s RMB 8 billion stake in Beijing Wanda Cultural Industry Group and a Beijing court in February put clamps on the group’s RMB 2 billion stake in Dalian Wanda Commercial Management.

At the end of September 2024 Dalian Wanda Commercial Management had RMB 3.9 billion of short-term loans, and payments on longer-term loans totaling RMB 40 billion, coming due within on year, against RMB 15.1 billion of available cash.

Last month Wanda Group agreed to sell its hotel management arm to a Tencent and Trip.com-backed travel company for RMB 2.5 billion ($347 million), marking the latest in a series of asset sales.

The group led by Wang Jianlin, formerly China’s richest man, gave up Wanda Hotel Development Limited after agreeing November to sell a 92 percent stake in British yacht builder Sunseeker International to US private equity firm Lionheart Capital and Italy’s Orienta Capital Partners for £160 million.

Earlier in 2024 the group sold its flagship hotel on Shanghai’s famed Bund to an Indonesian tycoon for an undisclosed sum. Also last year, Wanda sold its stake in film producer Legendary Entertainment after having acquired the studio for $3.5 billion in 2016.

Not including the latest sale, Wanda has sold over 30 Wanda Plaza shopping centres since 2023, according to local media accounts.

Leave a Reply