Cuscaden Peak is seeking S$750 million ($577 million) for The Clementi Mall (Image: Google)

An entity tied to mysterious mainland Chinese investors has emerged as the front-runner to acquire The Clementi Mall in western Singapore, market sources confirmed Thursday.

The suburban mall was put on the market at a guide price of S$750 million ($577 million) two months ago by Temasek-owned Cuscaden Peak, in a sales exercise that saw 12 bids whittled down to a shortlist of eight potential buyers. Sources told Mingtiandi that Cuscaden granted exclusive due diligence to a shortlisted party connected to Elegant Group, a property firm controlled by a family surnamed Zhao from China’s Guangdong province.

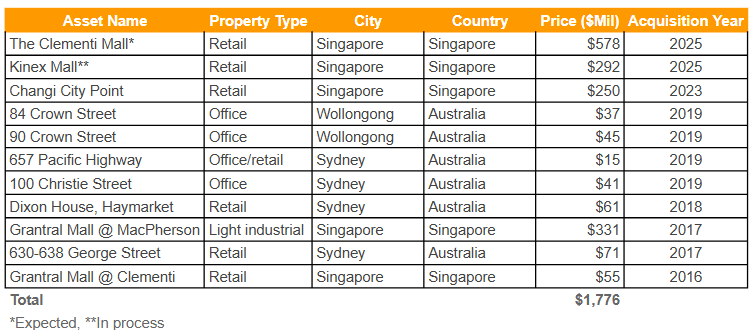

The Zhao clan’s source of wealth has never been publicly reported, but Elegant has built up a portfolio of three Singapore malls and six commercial properties in Australia since the group’s founding in 2015. A fourth Singapore investment, the S$375 million purchase of UOL Group’s Kinex mall in the Geylang area, is scheduled to close on Friday of this week.

Should the Zhao family and Elegant close on Kinex and acquire The Clementi Mall at or above the tender guide price, it would bring the group’s Singapore acquisitions to five properties at more than $1.5 billion. The deals would put the group’s purchases across Australia and Singapore at over $1.8 billion, according to Mingtiandi research.

The Zhao-linked entity’s shortlisting and due diligence for The Clementi Mall were first reported Wednesday by the Business Times. Elegant Group is expected to close on its purchase of the 195,772 square foot (18,188 square metre) mall within the next three weeks, market sources indicated to Mingtiandi.

The tender for the sale of The Clementi Mall was kicked off in early August with Savills and Cushman & Wakefield jointly managing the process on behalf of Cuscaden Peak.

Shopping Spree

The Zhao family made a splash in Singapore’s retail market two years ago with the acquisition of Changi City Point mall from Frasers Centrepoint Trust for S$338 million (then $250 million).

Cuscaden Peak CEO Gerald Yong

In 2017, a buyer linked to the family completed the en bloc purchase of the Citimac industrial complex in District 13 for S$430 million, based on local media reports, with Elegant later converting the property to a business park named Grantral Mall at MacPherson. Elegant also owns Grantral Mall at Clementi, acquired in 2016 for $55 million.

In July of this year, an Elegant subsidiary won a government tender for the redevelopment of a former shopping centre in Tanjong Katong with a bid of just over S$90 million. The group is set to transform the 30-year leasehold site into a new community and cultural hub serving the area near Paya Lebar MRT station.

Elegant entered Australia in 2017 with the purchase of two commercial properties in Sydney’s central business district for a total of A$94 million (now $62 million), with the assets now operating as a mall called 630-638 George Street. The following year saw the group buy the Dixon House commercial block in Sydney’s Chinatown for A$61 million.

Elegant Group/Zhao Family Known Deals

In 2019, Elegant picked up office buildings at 84 Crown Street and 90 Crown Street in the New South Wales city of Wollongong in two separate deals totalling A$118 million. Later that year it acquired a commercial building in Sydney’s St Leonards for around A$35 million, as well as a A$123 million mixed-use development project in the same North Shore suburb.

Elegant had not responded to Mingtiandi’s request for comment at the time of publication.

Portfolio Selldown

The Clementi Mall had been part of the portfolio of Paragon REIT, the SGX-listed trust taken private earlier this year by Cuscaden Peak, a 50:50 holding company of Temasek units Mapletree and CapitaLand. The trust’s other remaining assets absorbed by Cuscaden are the flagship Paragon mall on Orchard Road and a 50 percent stake in Westfield Marion Shopping Centre in Australia.

The 2011-built mall with a direct connection to Clementi MRT station and bus interchange is valued at S$3,831 ($2,946) per square foot of lettable area at the S$750 million guide price.

In addition to the Paragon REIT assets, Cuscaden continues to hold the Woodleigh Mall in north-central Singapore and the mall’s adjoining residential complex in a 50:50 joint venture with Japan’s Kajima Corp.

Cuscaden put Woodleigh Mall up for sale in July of last year for S$800 million. Sources told Mingtiandi at the time that parties showing buying interest included local heavyweights UOL and Frasers Property, Robert Kuok’s Allgreen Properties and Hong Kong-listed Link REIT.

Note: Deal values in the table have been updated to reflect historical conversion rates.

Leave a Reply