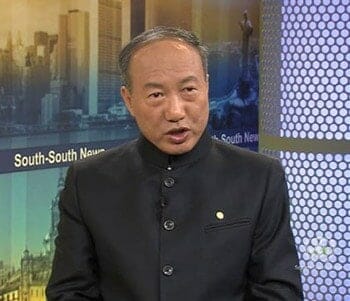

HNA’s chairman Chen Feng is set to cash in $6.5 billion selling stake in Hilton Worldwide

Debt-ridden HNA Group is planning to sell a stake in hotel operator Hilton Worldwide Holdings worth as much as $6.5 billion, after the group shed shares in two Hilton spinoffs in March for $2.4 billion.

The Hainan-based group is selling “some or all” of its 26.1 percent stake in Hilton Worldwide, a regulatory filing with the U.S. Securities and Exchange Commission Thursday shows. The 82.5 million shares HNA owns are valued at $6.5 billion according to the current share price.

Should the share sale plan be completed at the current stock price it would bring HNA’s assets sales this year to more than $13 billion, including sales of real estate in China and overseas, as well as stock holdings. The airline turned conglomerate is raising cash after a misbegotten global buying binge saw the company’s borrowings via bank loans and bonds rise to RMB 637.5 blllion ($101.1 billion) by the end of 2017.

Cashing in Its Hilton Rewards

HNA’s shares in the $25 billion hotel group originated from the group’s $6.5 billion acquisition of a one-fourth stake in Hilton Worldwide Holdings from Blackstone in 2016. Early last year, the hotel operator was split into three publicly listed firms, spinning off Park Hotels & Resorts Inc and Hilton Grand Vacations from the main hotel operator.

In desperate need of cash, the airline group sold 25 percent stakes in each of the two spinoffs last month for a combined $2.5 billion.

Around half of any potential proceeds from HNA’s planned sale of the Hilton Worldwide stake would likely go to a range of lenders including JPMorgan Chase, Credit Suisse, Deutsche Bank and UBS, which have already loaned the Chinese firm $3.5 billion against its shares in the NYSE-listed hotel giant. An SEC filing shows that HNA upped its borrowing against its Hilton stake to $3.5 billion from $3 billion last December, according to an account in Reuters.

Headquartered in McLean, Virginia, Hilton Worldwide has over 5,200 hotels worldwide under 14 brands including premium brands like Waldorf Astoria, Conrad and Hilton in 105 countries, the company’s corporate website shows.

HNA Sells Off China Real Estate

Will HNA staff lose their discount at the Waldorf Astoria Beijing once the sale is over?

In addition to overseas assets, the cash-strapped Chinese conglomerate has also been selling its properties in the country to pay off its debts accumulated via a $40 billion global acquisition spree over the past two years.

Just two weeks ago, HNA was reported to have sold a RMB 6.5 billion ($1 billion) residential project Haihang Shoufu (海航首府) in Haikou to Guangzhou R&F Properties. That Hainan housing deal followed HNA’s mid-March disposal of a pair of logistics projects on the southern Chinese island to mainland developer Sunac for RMB 1.9 billion ($300 million).

Meanwhile in Hong Kong, HNA has sold three of four residential land plots in the city’s former airport site in Kai Tak to Wheelock and Company for HK$6.36 billion ($811 million), and Henderson Land Development for HK$16 billion ($2 billion) in March and February respectively.

More HNA Property Sales on the Way

After disposing of more than $3.9 billion in Greater China property so far this year, still more sales are reportedly on the way. HNA is said to be marketing nine properties including office buildings and hotels in Beijing and Shanghai for $2.2 billion.

The HNA properties reported to be on the market include the 60-storey Shanghai HNA Tower on Lujiazui’s Puming Road, the Renaissance Shanghai Pudong Hotel — a 370-room hotel near the city’s Century Park and a 112,000 square metre business park project named Shanghai Yangtze International Enterprise Plaza.

Leave a Reply