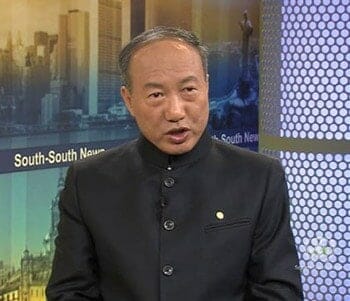

HNA Group chairman Chen Feng

China’s HNA Group became one of the world’s biggest investors last year by purchasing more than $10 billion in US assets last year, and snatched up at least that much or more in Europe, Asia and Australia. This string of acquisitions looks even more impressive now that the Beijing-based company’s domestic real estate subsidiary has revealed that it failed to make a profit in 2016.

Shenzhen-listed HNA Investment Group announced its 2016 earnings report late Friday which included a net loss of RMB 468 million ($67.9 million) as the company’s revenues declined compared to the previous year. The poor performance by HNA’s property arm came in a year when market leader Evergrande posted an 85 percent increase in sales, and number two developer China Vanke boosted its sales by 40 percent while still locked in a life or death takeover drama.

The numbers from HNA Investment, released on April 14, stated that the developer’s operating income declined year-on-year due to falling income from its real estate interests. Compared to the same period last year, the company’s operating profits, total profits, net profit attributable to shareholders and basic earnings per share decreased dramatically.

HNA Development Division Backs Away From New Projects

HNA Investment Group, established in 1993, added that the company was in a stage of transformation and would no longer add new real estate projects, with real estate sales revenues falling to RMB 256 million ($37 million) in 2016, down RMB 898 million ($130 million) from 2015. The company also attributed its losses to higher financial expenses last year – which included interest payments for a project in Tianjin. The cost of maintaining the developer’s debt increased to RMB 113 million ($16 million) in 2016, up by RMB 67 million from 2015.

On the same day that it revealed its 2016 earnings, HNA Investment released its preliminary report on performance in the first quarter of 2017, showing that from January to March 2017 the company is projected to turn a profit of between RMB 38 million ($5.5 million) to RMB 49.5 million, compared to a loss of RMB 3.6 million ($520,000) a year earlier. HNA Investment stated that these new gains come courtesy of returns on its 170,000 limited partnership shares in Zhongyichengxin Investment Partnership (中亿城信投资合伙企业).

Late last month HNA Investment Group signed a framework agreement with the Singapore-based AEP Investment Management and Yusof Bin Amir Wahid to jointly invest in REITs in Singapore, with an eye to creating to Special Purpose Vehicles.

More Losses in HK and HNA Group Still Buying

HNA is said to be close to buying Odebrecht SA’s stake in Brazil’s Rio de Janeiro airport

One asset that held HNA Investment back last year, according to its announcement, was its subsidiary Zibo Jiafeng Mining, which suspended production on orders from the local authorities. But in Hong Kong HNA’s arm was hindered by rough weather on the fairways.

HNA’s Hong Kong-listed unit, HNA Holding Group, posted losses for its sixth consecutive year late last month. The company reported an annual net loss of HK$21.9 million ($2.8 million) for 2016 due to unfortunate bad weather and fierce competition hitting revenues at its Dongguan Hillview Golf Club. The golf course was closed for 426.5 hours in 2016 due to bad weather, compared to just 91 hours in 2015.

HNA Group, on the other hand, has continued to be one of the world’s most acquisitive companies, surpassing $40 billion in deals in just over two years, according to data from the Financial Times, which includes the recent $1 billion deal for CWT’s 1.5 million square metres of warehouse assets. Most recently, HNA is said to be close to buying Odebrecht SA’s stake in Brazil’s second-busiest international airport in Rio de Janeiro.

Leave a Reply