Despite operating a failed REIT which lost billions, and being accused of fraud by the government of their home country, two former directors of Treasury China Trust are now said to be receiving payouts of Euros 40 million each.

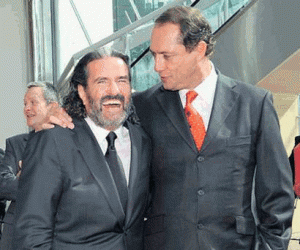

According to a report in the Irish Times, Richard Barrett and Johnny Ronan, who ran the now bankrupt Treasury Holdings and its Singapore listed subsidiary, Treasury China Trust, have reached a settlement with the Irish government which will allow them to keep a portion of the proceeds of their recent sale of a controlling interest in Forterra Trust and its related companies to Hong Kong’s Nanfung group.

The July sale of what had been the assets of Treasury China Trust to Nan Fung is reported to have gained Euros 138 million for the former Treasury directors, and the Euros 40 million each would apparently be deducted from this sum. Once they have pocketed this windfall, Barrett and Ronan are to return the remaining Euros 58 million to the creditors of Treasury Holdings, which is currently undergoing bankruptcy proceedings in Ireland.

In the case of former director Richard Barrett, according to the Times story, he has negotiated a Euros 5 million success fee for completing the Nan Fung sale, as well as a Euros 35 million cash payment to himself. His former co-director, Ronan is believed to be receiving a similar benefit from the deal.

Before making the sale to Nan Fung, Forterra (as the former Treasury China Trust was by then known) was able to sell off the Central Plaza building in Shanghai to the Carlyle Group for US$266 million. The disposition of the proceeds of this sale were not made clear in the settlement.

The settlement of the case against Barrett and Ronan was first proposed on July 25th, and has now been approved by the presiding judge as being both legally and commercially justified.

Barrett and Ronan were apparently able to pull off this bit of legal jiu-jitsu, by having a cleverly structured shareholders agreement, and then carrying out two transactions last year that stripped the China assets from their doomed Irish parent company and transferred them to more personally controlled corporate vehicles.

These transactions were the basis for the fraud allegations brought in Ireland, and the documents around the court settlement have brought forth more details of the case.

Court Affidavits and Settlement

When Treasury Holdings began defaulting on the loans that propped up their property empire, many of the company’s debts were taken over by the Irish government’s “bad asset” bank, NAMA. And when the settlement was proposed, it first needed to receive support from the representatives of NAMA and the other creditors.

According to the court affidavits filed by the lawyers for the creditors, due to the challenges faced in pursuing the former Treasury directors and the purloined assets, Michael McAteer, the liquidator of Treasury Holdings, believed it was the best deal for the creditors to accept the deal proposed by Barrett and Ronan. The judge overseeing the case is said to have reluctantly approved the settlement.

Getting back Euros 58 million may be better than nothing, but seeing how Treasury Holdings left the Irish public owning debts of some Euros 1 billion, it may not feel that much better than nothing.

Leave a Reply