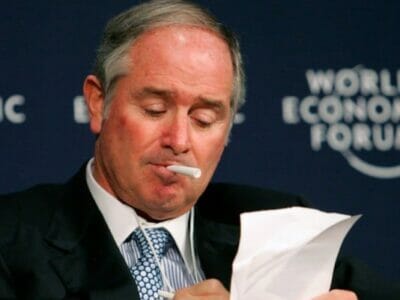

Blackstone chief Stephen Schwarzman carefully chewed on the facts before committing another $2.3B to Australian assets

US private equity giant Blackstone has placed a A$3.08 billion ($2.3 billion) cash bid to take over Investa Office Fund (IOF), an Australia-listed real estate investment trust with a portfolio of 20 downtown office assets in Sydney and other cities.

According to a statement Monday, the fund’s directors unanimously recommended the indicative, non-binding offer by Blackstone. The news comes less than two weeks after Blackstone bought up an office portfolio in Auckland, New Zealand from a joint venture of Goodman Property Trust and Singapore’s GIC.

The approval follows a series of unsuccessful grabs at the coveted asset cache. IOF shareholders rejected a A$2.5 billion takeover bid from Australia’s Dexus Property Group just over two years ago, and Cromwell Property Group made two failed attempts to acquire the trust in 2016 and 2017. Sovereign wealth fund China Investment Corporation (CIC) was also said to be considering a bid for IOF in early 2016, less than six months after CIC bought the Investa Property Trust (IPT) portfolio of office assets from Investa Property Group.

The latest Blackstone offer “presents IOF unitholders with an opportunity to realise their investment in IOF for significant value and certainty,” according to today’s statement.

Investa Directors Feel the Price is Right

IOF counts Foster + Partners-designed Deutsche Bank Place among its assets in Sydney

The statement indicates that Blackstone offered A$5.25 in cash for each unit of the REIT, which is 13 percent more than the Australian Stock Exchange (ASX)-listed trust’s closing price on Friday. Blackstone made an initial, unsolicited offer of A$5.05 per share on April 5, and submitted the higher bid on May 4 after a month of confidential talks with IOF.

The revised Blackstone offer represents a 4 percent premium to the trust’s net tangible assets per unit, which stood at A$4.95 at the end of 2017. The proposal was placed by funds managed or advised by Blackstone Singapore Pte Ltd or its affiliates.

The directors of Investa Listed Funds Management Limited (ILFML), the responsible entity for IOF, will unanimously recommend that IOF unitholders vote in favour of the proposal in the absence of a better offer, subject to an independent review, the announcement says.

Blackstone Poised to Add 20 Assets to $120B Portfolio

New York-based Blackstone has around $450 billion of assets under management globally including nearly $120 billion worth of real estate. Through the acquisition of IOF, Blackstone would gain a portfolio of 20 investment-grade buildings in core downtown markets across Australia, spanning nearly 544,000 square metres and occupied by some 430 tenants.

The ASX-listed REIT has A$4 billion of total assets under management with an occupancy rate of 97 percent across its properties and a weighted average lease expiry of 4.8 years. Ten of the assets are located in Sydney, with another five in Brisbane, a pair of holdings in both Perth and Melbourne, and a single asset in Canberra.

The Sydney portfolio includes a stake in the premium office building Deutsche Bank Place at 126 Phillip Street and full ownership of grade A building 347 Kent Street, among other assets. The trust’s Melbourne investments include half ownership of 242 Exhibition Street, which serves as Telstra’s global headquarters.

PE Giant Is Bullish on Offices Down Under

Investa Property Group, one of Australia’s largest commercial real estate firms, owns and/or manages 37 assets in the country through IOF as well as via Investa Commercial Property Fund (ICPF), its core prime office fund for institutional investors, which has 15 assets.

Morgan Stanley sold the Investa Property Trust office portfolio to CIC for A$2.45 billion ($1.79 billion) in July 2015, after putting the broader Investa Property Group on sale in April of that year. The US investment bank wrapped up its sale of the Investa platform in March 2016.

Blackstone’s bid on IOF further bolsters confidence in Australia’s booming commercial property market, at a time when strong leasing activity in downtown office markets in Sydney and Melbourne is driving vacancies to near-record-lows of 4.6 percent each, according to a recent report by Colliers International. Tight vacancies are pushing up rents while heightened investment activity is compressing yields, now estimated at 5.0 percent and 4.8 percent for premium office assets in Sydney and Melbourne, respectively.

In January, Blackstone Real Estate Partners (BREP) Asia fund was reported to be buying the 1 York Street office tower in downtown Sydney from troubled Chinese conglomerate HNA Group for about A$200 million ($161 million)

Chaired by Stephen Schwarzman, Blackstone bought a seven-building, 88,000 square metre commercial office portfolio in Auckland for NZ$635 million ($438 million) earlier this month.

Leave a Reply