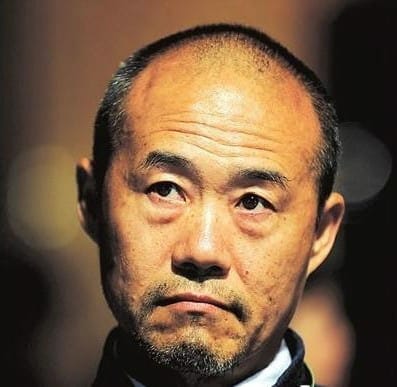

Vanke’s Wang Shi seems to be considering all the cool stuff he could do with RMB 1.8B

China’s largest real estate developer may just be getting RMB 1.8 billion ($290.5 million) for Christmas this year as Vanke takes advantage of more lenient government rules and lower interest rates to refinance its debt.

According to an account in Bloomberg, the Hong Kong-listed company will issue three year securities on December 24th via China’s interbank market. The proceeds of the bond sale are said to be targetted at repaying the company’s bank loans.

Developers Issuing More Bonds in China

The domestic bond issue comes as China’s real estate developers begin to shift back to their home market for financing after a record run of offshore bond deals in the last two years.

China only began permitting onshore bond sales again in April this year, as the industry began to suffer from a lack of credit. Prior to April, no bonds had been issued by real estate companies in China since December 2009.

Interest Rate Cut Makes Bonds More Affordable

With the country’s real estate market mired in its deepest slump in five years the People’s Bank of China reduced interest rates on November 21st. That move made it more affordable for Vanke to issue this upcoming debenture, and increased public enthusiasm for developer stocks and related securities.

Vanke’s notes will benefit from trading on the interbank market, which is the largest of China’s bond bourses. In September, the government announced that developers rated AA or higher would be allowed to sell debt on the exchange. Other builders issuing debt this year, such as Jiangsu Future Land, have had to make do with trading on smaller markets.

Leave a Reply