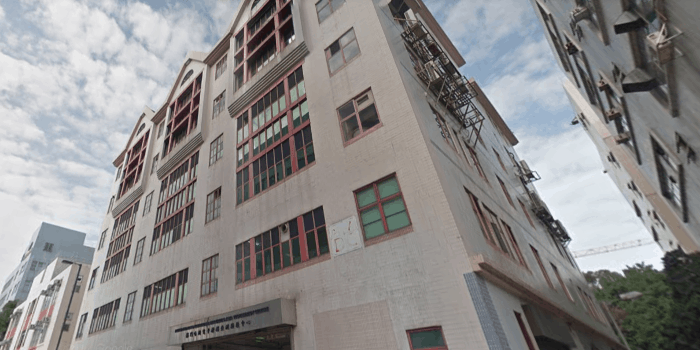

Chiaphua Industries acquired the industrial building at 15 On Lok Mun Street for HK$150 million

Hong Kong conglomerate Chiaphua Industries has this month acquired a 25-year-old industrial building in the Fanling area of the New Territories for HK$150 million ($19.2 million), as aging sheds with revitalisation potential continue to lure investors.

The seven-storey building at 15 On Lok Mun Street sits on a 9,688-square-foot site near the Shenzhen border and was owner-occupied by Rohm and Haas Electronic Materials for high-tech industrial usage. The Hong Kong Economic Times reported on the en-bloc sale citing information from the Land Registry.

CBRE, which was appointed as sole agent for the sale in September, described the opportunity as a sale-leaseback deal. Reporting at the time indicated that the asset had an asking price of HK$225 million when it hit the market.

Plot Ratio Could Increase by 20%

With a maximum plot ratio of 5, the site can yield a property of up to 48,440 square feet upon redevelopment, implying a value of HK$3,097 per square foot. The asset could also benefit from the government’s industrial building revitalisation scheme, rebooted last year, under which the building’s plot ratio could be relaxed by 20 percent. This would enable a floor area of about 58,128 square feet, equating to a price of HK$2,581 per square foot.

Herbert Cheng’s Chiaphua Group is picking up some New Territories assets

Located in the heart of the Fanling On Lok Mun industrial area, the building is a 15-minute drive to the Heung Yuen Wai Control Point, a land border control point still under construction. Although its location makes the facility ideal for tenants involved in cross-border trade, logistics and freight forwarding, it can also be converted for retail, education, elder care or data centre uses, according to a statement by CBRE.

The brokerage noted that the property has undergone significant upgrades since it was built in 1994, making it well-suited for research and development and lab testing activities.

Data Cente Firm Snaps Up Vintage Building

Elsewhere in the New Territories, data center operator GDS Services acquired the 47-year-old Milo’s Industrial Building in Kwai Chung for HK$880 million in late October. The property at 2 Tai Yuen Street changed hands for the equivalent of HK$4,500 per square foot.

The vintage building, which will be converted into a new data center, spans a gross floor area of 195,000 square feet atop a 20,000-square-foot site. Redevelopment under the industrial revitalisation policy could potentially boost the total building area to 234,000 square feet.

This past August, Beijing-based GDS Services also bought the Cargo Services Group’s logistics center at 2 Lam Tin Street, about 300 meters from its latest acquisition, for HK$770 million, or HK$4,000 per square foot.

Savills Hawks Kowloon Deal

The recent deals suggest that older industrial properties with redevelopment potential are still attracting interest from the market even as other commercial property sectors in Hong Kong slump in the face of political and economic turmoil.

More transactions could be in the works, as property agent Savills is said to be selling an industrial building at 550-556 Castle Peak Road in Kowloon’s Cheng Sha Wan through a public tender, which will be closed on December 16. The tender values the 12-storey property at HK$1.2 billion.

Completed in 1981, the Hang Fat Industrial Building sits on a site of 5,837 square feet with a total gross floor area of 156,087 square feet. The property could potentially be redeveloped into an office building of up to 190,044 square feet after a land use conversion premium has been paid.

The industrial market also registered a major deal on Hong Kong Island earlier this month, with Kerry Properties acquiring six floors of the Remex Center in the Wong Chuk Hang area for HK$500 million. The strata-titled floors within the 41-year-old industrial building were sold at a 38 percent markdown to the Hong Kong-listed developer after being listed in March 2018 with a price tag of HK$800 million.

The 23-storey building at 42 Wong Chuk Hang Road has been repositioned by a number of co-working operators to take advantage of the area’s growing popularity as an affordable office hub.

Leave a Reply