Albert Yeung’s latest prize isn’t so easy to carry around.

Just three months after purchasing HNA Group’s principal Hong Kong real estate subsidiary for HK$7 billion (then $894.8 million), Blackstone has sold one of the company’s highest profile assets for HK$595 million, according to a pair of announcements to the Hong Kong stock exchange today.

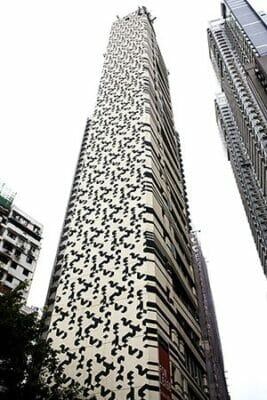

Emperor International Holdings, a Hong Kong conglomerate controlled by local tycoon Albert Yeung, declared its purchase of the holding company for 151 Hollywood Road, a 32,727 square foot (3,040 square metre) commercial property in the city’s Sheung Wan area, to the bourse.

In a separate notice, Hong Kong International Construction Investment Management Group Co. Ltd (HKICIM), which had been a unit of HNA Group until the financially challenged mainland firm sold the real estate firm to Blackstone in March, revealed that it was selling the building also known as CentreHollywood.

Local Tycoon Adds Sheung Wan to Portfolio

In its statement to the exchange, Emperor International said that adding the property, which it considers to occupy a favourable position in the area just west of Hong Kong’s Central commercial hub, would help the group to optimise its portfolio of investment properties and broaden its income base.

CentreHollywood in Hong Kong’s Sheung Wan area

For the year ending 31 March 2019, the 26-storey property is said to have earned profit after taxation of just less than HK$27 million. Yeung’s holding firm is paying the equivalent of HK$18,181 per square foot for the 1994-vintage tower, according to Mingtiandi calculations.

At the time that Blackstone acquired HKICIM in March, offices in the property 400 metres uphill from the Sheung Wan MTR station were listed for lease on local websites for between HK$40 to HK$50 per square foot per month.

As of 31 March 2018, Emperor International had a portfolio of some 50 investment properties in Hong Kong,, Macau, mainland China, and the UK, with another three under development. The company’s real estate assets in Hong Kong feature a set of broad range of shopfronts in prime locations, as well as office buildings, strata title commercial assets, residential units and workshops.

Blackstone Finds a Time to Sell in Hong Kong

In its own announcement, HKICIM said that the transaction, which is expected to close on 19 August 2019, was part of its effort “to optimise and rationalise the assets portfolio of the Group by realising the real estate assets of the Group in Hong Kong.”

HNA Group sold the listed company to Blackstone in March as part of its ongoing scramble to bail out its balance sheet, an the US firm now maintains that. given current market conditions and trends in Hong Kong, it considers the disposal to represent a good chance to raise cash that could be used for other investments.

The US private equity giant had acquired HKICIM in March by purchasing a 69.54 percent stake from HNA Group, which in addition to Blackstone’s existing holdings, gave Stephen Schwarzman’s investment firm 71.5 percent of the listed company’s stock.

Prior to the Blackstone investment, HKICIM had sold the last of four housing projects it had acquired in the Kai Tak area to Wheelock & Company at the end of January.

Following the sale of 151 Hollywood Road, HKICIM is understood to own a 165,000 square metre mixed-use property in Shenyang, as well as a floor in Wheelock’s One Island South office development in Hong Kong’s Wong Chuk Hang area, in addition to various other assets.

Leave a Reply