Pan and Zhang may own Wangjing Soho in Beijing for at least a bit longer

Blackstone is said to have ended discussions over a potential HK$31 billion buyout of mainland commercial developer Soho China due to current market conditions undermining the feasibility of the deal.

The US fund management giant has pulled back its offer to take over the Hong Kong-listed firm and its portfolio of eight commercial properties in Shanghai and Beijing as market instability has made assessing the developer’s prospects challenging, according to a source cited by Bloomberg.

Blackstone’s concern over the deal is said to have been exacerbated by uncertainty in the debt market, which has made financing a potential transaction problematic in the current climate.

The report comes just under two months after Soho China confirmed that it was in discussions with overseas investors over a possible buyout, following reports that it had entered into exclusive discussions with Blackstone.

Stepping Back from a Problematic Deal

The talks between the US fund management giant and the Beijing-based developer, which are said to have still been at an early stage, may be resumed when the market levels off, according to sources cited by Bloomberg.

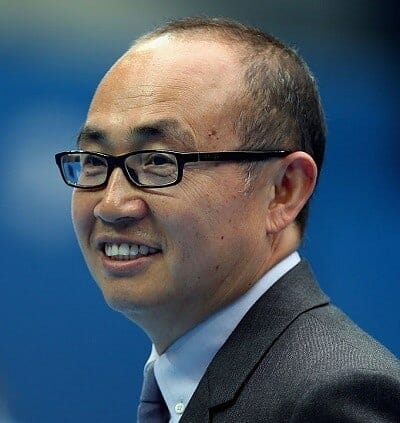

Soho China chairman Pan Shiyi’s plans to sell his company have come to an unhappy end

The deal would have given Blackstone possession of Soho China’s commercial property portfolio in Beijing and China, but would also have seen the firm take over the developer’s debt pile, which totalled RMB 32.7 billion ($4.6 billion) as of the end of June 2019.

Shares in Soho China fell by 23 percent from HK$3.52 ($0.45) to HK2.70 following yesterday’s report, but had risen to HK$3.10 by the close of trading on 5 May.

With Blackstone said to have been offering HK$6 per share to take the firm private – more than double the company’s 5 March HK$2.98 share price – the proposed buyout of the developer led by husband and wife team Zhang Xin and Pan Shiyi, would have valued the company at over HK$31 billion.

The deal, had it proceeded, would have been the US private equity firm’s biggest investment to date in China’s real estate sector as Blackstone continues to ramp up its holdings on the mainland and in other parts of the region after closing on $7.1 billion in 2018 for its largest Asia property fund.

Two years before that fund raise, the company sold off its interest in a portfolio of shopping centres in mainland China, which included a 40 percent stake in mall developer SCP, to a consortium led by mainland developer China Vanke for $1.9 billion.

Looking for a Buyer

Soho China’s pursuit of a buyer for its assets was first revealed last October, with the developer reported to have been looking to sell a RMB 61 billion portfolio of commercial properties.

With four buildings each in Beijing and Shanghai, including the Zaha Hadid-designed Soho Galaxy, these assets total 825,851 square metres (8.9 million square feet) according to the company’s most recent annual report.

In addition to Blackstone, other potential suitors for Soho and its portfolio were said to have included Singapore sovereign wealth fund GIC.

Adopting a Buy to Sell Strategy

With Pan and Zhang having effectively shifted the company into a build to sell development model after struggling to make money from rental income, Soho has focused increasingly on offloading assets as an avenue to profits.

In 2018, the developer sold a pair of assets at its Sky Soho project in Shanghai to Gaw Capital Partners for RMB 5 billion, with that Hongqiao area deal following the company’s 2017 sale of the Soho Hongkou project in Shanghai to a consortium including Keppel Land China, Alpha Investment Partners and Allianz Insurance for RMB 3.6 billion.

Blackstone has thus far declined to comment on the reported talks with Soho, while it’s Beijing-based counterpart had not replied to an enquiry from Mingtiandi at the time of publication.

Leave a Reply