The Ritz-Carlton, Okinawa’s 97 rooms are surrounded by golf (Image: Ritz-Carlton)

Blackstone is doubling down on one of its favourite Asian property plays with the US private equity giant having agreed to purchase a pair of Japanese resorts in a JPY 20 billion ($130 million) deal, according to market sources who spoke with Mingtiandi.

The New York-based firm is acquiring the Ritz-Carlton, Okinawa and the Kanehide Kise Beach Palace from local conglomerate Kanehide Holdings Co, the sources said, confirming earlier reporting by Bloomberg, with analysts predicting that Blackstone could reap benefits from upgrading the resorts on Japan’s southernmost island, particularly the 3-star Kanehide Kise Beach Palace.

“This property may have some upside potential after capex and conversion to an international brand,” said Dan Voellm, CEO and founder of hotel investment consultancy AP Hospitality Advisors. “In the scope of the transaction, the Ritz would by far have the greater weighting in the transaction, potentially around 75 percent, and represent an attractive price compared to replacement cost.”

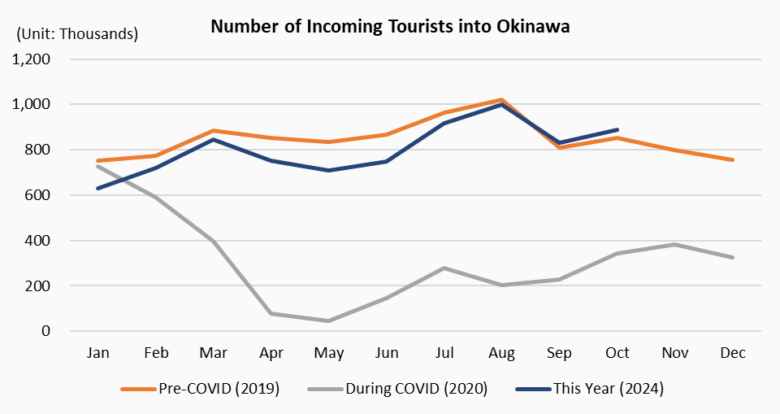

The transaction comes as visitor levels in Okinawa have surpassed pre-Covid levels this year, with other major investors also having picked up hotels on the island during 2024. Blackstone has made hospitality properties one of its top targets, including steadily picking up Japanese hotels in the past four years.

Golf Destination

After opening as the Kise Bettei Hotel & Spa in 2007, the Ritz-Carlton was upgraded to its current status in 2012 through a JPY 1 billion renovation.

Daisuke Kitta, head of Japan real estate for Blackstone

The two hotels are located within the Escape to Kise Country Club with the RItz-Carlton surrounded on three sides by the golf destination’s 18-hole, championship course overlooking the ocean.

The 5-star resort has 97 keys with the Kanehide Kise Beach Palace having 162 rooms and suites. While improved asset management could potentially boost yields from the Ritz-Carlton, Voellm noted that the resort currently has among the lowest average rates under the brand in Japan, given the seasonal nature of its business.

Tourism in Okinawa is currently dominated by domestic traveller enjoying short stays, which has stunted resort demand. Voellm sees opportunities for Blackstone to enjoy healthier returns if it is able to attract foreign visitors to the resorts.

Despite the challenges, Blackstone has picked up the resorts at a rate seen as appealing amid an upswing in tourism in Asia’s second largest economy, while it still faces obstacles from rising labour costs and other operating obstacles.

“It would be reasonable to estimate that the transaction price for the Ritz-Carlton was at or above $1 million per key,” Voellm said. “Given current replacement costs, that is very attractive, yet profitability with such a small room count and required staff ratios would drive a relatively lower yield.”

Blackstone representatives declined to comment on the transaction while Kanehide Holdings Co had yet to respond to inquiries from Mingtiandi by the time of publication.

Okinawa on the Rise

Hideaki Suzuki, senior research director and head of business development services at Cushman & Wakefield Japan, sees Blackstone’s latest hotel investment benefitting from a tourism upswing in Okinawa as travel booms across Japan.

The weaker currency is bringing Japan as a hot spot for foreign tourists to Japan, especially Okinawa has one of the most beautiful seas in the world, and the white sand beaches and blue seas attract tourists,” said Suzuki. He added that the weaker yen is persuading more Japanese tourists to travel domestically.

During 2024 travel to Okinawa has rebounded to surpass 2019 levels after dropping during the pandemic. Some 2.71 million visitors stayed in Okinawa from August through October of this year, up nearly 2 percent from the same period in 2019, according to Cushman & Wakefield figures based on government data.

Source: Cushman & Wakefield

Tetsuya Kaneko, director and head of research and consultancy at Savills Japan, sees particular potential in Okinawa’s high-end resorts.

“Okinawa, in particular, is benefiting from its position as a luxury travel destination, which seems to have attracted Blackstone’s interest,” Kaneko said. “Their investment strategy is likely rooted in the region’s strong post-pandemic recovery and long-term growth potential.”

In June of this year, Japan Hotel REIT, a Tokyo-listed trust sponsored by Singapore’s SC Capital Partners, agreed to buy four Okinawa hospitality properties for JPY 56.2 billion.

Hotel Lovers

The Okinawa transaction, which has been revealed less than a week after Blackstone announced that it has agreed to buy the Tokyo Garden Terrace Kioicho commercial complex in Japan’s capital from Seibu Holdings for $2.6 billion. That twin tower property includes a 250-key luxury hotel.

That deal, which ranks as Blackstone’s largest investment to date in Japan, comes one year after the NYSE-listed firm purchased a Kyoto hotel from Goldman Sachs for JPY 8 billion.

In 2021 Blackstone purchased eight Japanese hotels from Japanese rail operator Kintetsu Group Holdings with the assets having carried a book value of JPY 42.3 billion as of March 2020.

Leave a Reply