The world’s largest money manager is about to become one of the globe’s biggest investors in ports, bridges and cell towers, with BlackRock announcing Friday that it has agreed to buy Global Infrastructure Partners in a combined cash and stock deal valued at around $12.5 billion.

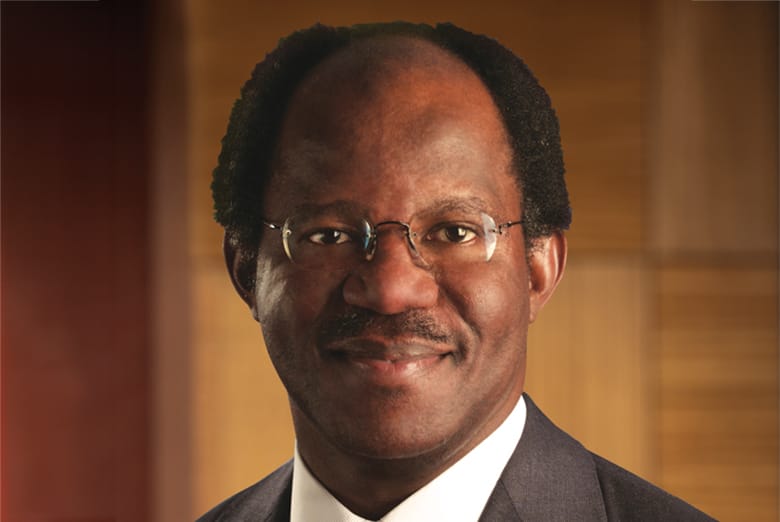

Based in New York, GIP manages around $100 billion in assets, with BlackRock paying $3 billion in cash and around 12 million of its shares to acquire the company helmed by former Credit Suisse executive Adebayo Ogunlesi, according to a statement.

“Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy,” BlackRock chairman and chief executive Larry Fink said. “We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors.”

In May of last year, a GIP joint venture won approval to acquire cell tower operator TowerVision India in a deal valuing the company at around $300 million, and the company led a $17.5 billion 2021 acquisition of Sydney’s airport authority. Media reports in December indicated that GIP was in talks to acquire Queensland Airports Limited, the main airport operator in the Australian state.

Counting on Policy Support

Calling infrastructure a $1 trillion market, BlackRock pointed to the sector’s potential for growth in response to rising demand for better digital infrastructure, including fibre networks, cell towers and data centres, as well as growing investment in transport hubs such as airports, railroads and shipping ports as supply chains evolve.

The asset manager noted that the deal will triple its infrastructure assets under management as governments worldwide increasingly emphasise development of alternative energy

“Policymakers are only just beginning to implement once-in-a-generation financial incentives for new infrastructure technologies and projects,” Fink said.

GIP’s ability to source profitable infrastructure projects and raise capital figures into the acquisition, with the company having raised $22 billion for its Global Infrastructure Partners V fund, according to the statement. The company set a $25 billion target for the vehicle in 2022 after raising $22 billion for the fourth edition of the strategy.

BlackRock sees GIP’s strategies blending with its existing offerings, as the infrastructure specialist’s proprietary origination and business improvement capabilities complement BlackRock’s corporate and sovereign relationships globally.

Leadership Stays On

“Investors have adopted private infrastructure investing for its ability to provide stable cashflows, less correlated returns, and a hedge against inflation,” GIP founding partner, chairman and chief executive Bayo Ogunlesi said. “Global corporates have turned to private infrastructure as a fast innovator and a more commercially agile owner of infrastructure assets that aren’t core to their commercial businesses.”

Ogunlesi predicts that following the merger with BlackRock, the combined platform will be the pre-eminent infrastructure solution provider for global corporates and the public sector, highlighting the venture’s ability to mobilise long-term private capital through its relationships.

Having founded GIP in 2006, Ogunlesi and four of the company’s other founding partners will lead the combined venture following the acquisition.

The partners said GIP’s leadership will bring with them to the platform their investment and operations teams. As part of the deal, which is expected to close in the third quarter of this year, Ogunlesi is expected to join BlackRock’s board.

Perella Weinberg Partners served as lead financial advisor to BlackRock, with Skadden, Arps, Slate, Meagher & Flom and Fried, Frank, Harris, Shriver & Jacobson LLP acting as legal counsel. Evercore served as lead financial advisor and Kirkland & Ellis LLP and Debevoise & Plimpton LLP acted as legal counsel to GIP.

Leave a Reply