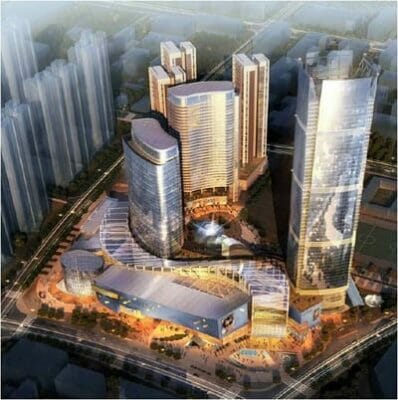

The 973,000 sqm Kaisa Central Plaza is one of the two Shenzhen projects that CITIC is suing to seize.

The credit problems facing Kaisa Group continue to deepen as it was revealed today that at least three financial institutions, including Chinese state-owned banks, are suing the troubled real estate developer and seek to seize the company’s projects.

According to a report in the 21st Century Business Herald, on January 7th three financial firms which had lent funds to Kaisa applied to the courts in Shenzhen to request seizure of assets from the developer in the southern Chinese city.

Following close after the news today that Kaisa had defaulted on a payments on a $500 million offshore bond, this latest financial setback for the Shenzhen-based company appears to put in even greater danger of further defaults.

Lawsuits Seek Seizure of More than RMB 3B in Assets

According to the local media account, sources inside the Shenzhen Intermediate People’s Court indicated that the lawsuits filed against Kaisa sought seizure of assets valued at more than RMB 3 billion ($483 million). Shenzhen is home base for the once high-flying developer and also the site of many of its real estate projects.

The 21st Century Business Herald report did not specify which banks were pursuing Kaisa through the courts, but pointed out that the developer had borrowed funds from an estimated 11 banks, and incurred further debts to at least 10 trust companies.

Official Media Covering Suit by State-Owned Bank

According to a report on the website of the official People’s Daily today, the Shenzhen Intermediate People’s Court has announced lawsuits by China CITIC bank seeking seizure of two properties owned by subsidiaries of Kaisa in the southern Chinese city.

The two properties being pursued are said to be the same two projects where two partners of Kaisa began pursuing the developer for refund of RMB 1.2 billion ($196 million) in fees after sales at the unfinished developments were frozen by the government.

Update 2014-01-11: According to a report in Caixin, in addition to China Citic, Bank of China’s Shenzhen branch and a trust investment subsidiary of China Resources have also filed requests with the court seeking seizure of Kaisa’s assets. The developer apparently told Caixin that it had received no information from the court.

In all, Kaisa has announced that sales at four of its projects in Shenzhen have been frozen by the city government. The developer has yet to make any statements regarding the lawsuits.

CITIC Case Includes 973,000 Sqm Mega-Project

In one of the two projects which CITIC is seeking to claim, Shenzhen Yuefeng Garden, Ping An Trust, a unit of China’s state-owned insurance giant, is said to hold a 20 percent stake. Yuefeng Garden is among the four projects where sales have been frozen by the city government, according to an earlier statement by Kaisa.

The other project which CITIC is suing to have seized is Shenzhen Kaisa Central Plaza (also known as Kaisa City Plaza), a 973,000 square metre mixed-use project that includes grade A office space, a five-star hotel, a shopping mall and housing. Kaisa Central Plaza was also subject to a government ban on sales of its residential space from November 28th, according to Kaisa’s earlier statement.

Kaisa Financial Failures Appear to Trigger Cross-Defaults

The lawsuits by CITIC and the other financial institutions indicate that Kaisa’s earlier failures to meet its financial obligations have now likely triggered cross-default clauses in its agreements with its creditors, furthering deepening its financial distress.

The first cracks in Kaisa’s finances began to appear at the beginning of this month, when the developer revealed that HSBC had notified it of a default on a HK$400 million ($51.6 million) loan. This initial default was triggered by the departure of the company’s chairman, Kwok Ying-shing on December 31st.

The company revealed the claims by its partners against the two frozen projects on Tuesday of this week.

On Thursday Kaisa fell into a deeper debt hole when it failed to distribute $26 million in interest payments due on a $500 million bond. The developer has made no statement regarding its default on the offshore bond payment.

Beyond its bonds, Kaisa’s most recent financial statements showed that the developer had RMB 7.2 billion ($1.16 billion) of bank loans as of June 30th.

Some estimates put the company’s total debt obligations at RMB 30 billion ($4.83 billion), and now with this latest evidence emerging of more creditors demanding payment of financial obligations, Kaisa’s ability to renegotiate its financing appears to be dwindling.

Unless the government changes course and decides to release the company’s frozen projects, the Hong Kong-listed developer could be on its way to becoming China’s biggest ever real estate bankruptcy.