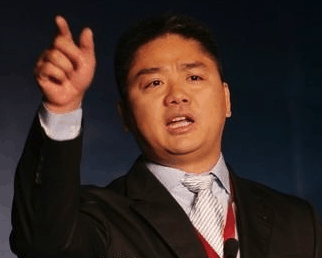

Tang Xuebin, founder of Colour Life

Mainland e-commerce giant JD.com and internet security provider Qihoo 360 Technology have agreed to buy a combined HK$491 million ($62.87 million) stake in Shenzhen-based residential property manager Colour Life, according to a statement to the stock exchange by the Hong Kong-listed company.

The investment in Colour Life, which provides tech-enabled property management to residents of more than 1.12 billion square metres (12 billion square feet) of housing across 268 Chinese cities, is being accomplished through a special offering of new shares.

The investment by JD.com and Qihoo 360 represents the latest bet by China’s Internet giants on property industry players following a series of offline deals by e-commerce firms over the past two years.

JD, Qihoo Take Minority Stakes in Property Manager

As described in the stock market announcement, Colour Life is entering a pair of equity transactions, with the largest involving a sale of 71.15 million new shares to JD.com at a price of HK$5.22 each. The HK$371 million deal represents 5 percent of the issued share capital of the company following completion of the two share sales.

The 19-year-old property management company also noted in the statement that it has entered into a second subscription agreement with Beijing-based Qihoo 360, a provider of anti-virus systems and other security software which is controlled by Zhou Hongyi, who also serves as a non-executive director of Colour Life.

Under the terms of this second transaction, Qihoo 360 will subscribe to 22.96 million new shares in Colour Life at a price of HK$5.22 per share. That HK$120 million investment increases the software firm’s stake in Colour Life from 1.54 percent to 3.05 percent following conclusion of the sale.

Colour Life explained in the statement that JD.com’s share purchase will enhance the company’s ability to raise funds and broaden its capital base, as well as fostering greater cooperation with the e-commerce giant in online transactions, logistics and finance.

The property manager noted many of the same benefits could be expected from Qihoo 360’s investment, along with potential to improve Colour Life’s security capabilities and strengthen its ability to leverage big data, IoT and artificial intelligence in its services to community residents.

Expanding Existing Partnerships

JD.com, headed by Liu Qiangdong, buys HK$371 million shares in Colour Life

Founded in 2002, Colour Life in 2014 became mainland China’s first residential property manager to be listed in Hong Kong. The Shenzhen-based company focuses on providing an integrated property management platform which includes smart logistics, intelligent building management and community services.

The company has been partnering with JD.com by leveraging the e-commerce player’s platform to allow Colour Life’s customers the opportunity to earn rebates after purchasing property management services like cleaning the air conditioner, changing gas canisters or event fixing plumbing.

The two companies have also launched a number of pilot programs to explore further opportunities to cooperate in retail, finance and user-end logistics in smart communities.

According to its most recent financial report, Colour Life had RMB 3.61 million of revenue in 2018, up 121.9 percent from the previous year. The company’s net income stood at RMB 485 million, up 51.3 percent.

JD.com first stepped into the real estate market in 2017 when the technology giant created a property section on its online retail website. Then, last October, JD.com announced a partnership with one of China’s biggest housing brokers, 5i5j, to make it easier for the nearly 500,000 monthly visitors to JD.com to buy and lease homes online.

Leave a Reply