Greystar is eyeing multifamily acquisitions in Japan

Greystar Real Estate Partners has announced the appointment of Akira Kosugi as managing director of its Japan business as the US-based rental apartment developer embarks on the next stage of its Asia expansion.

The company’s newly launched Tokyo office brings its Asia Pacific bases to four – joining three existing locations in Shanghai, Sydney and Melbourne.

Tasked with securing a foothold in what Greystar’s founder and CEO Bob Faith calls “one of the top markets in the world with a developed institutional multifamily ownership”, the company is already gearing up to make its first Japanese acquisition, according to the former country head of both New York-based property investment management firm Westbrook and US private equity giant Blackstone.

The establishment of Greystar’s Japan office follows some $500 million in China-dedicated capital raised through Greystar’s Asia platform, which the firm established in 2018. The multifamily fund is backed by Dutch fund managers APG Asset Management NV and Bouwinvest Real Estate Investors, with Saudi Arabia’s direct investment arm Wisayah having made a fresh commitment to the fund last month.

Greystar’s capital strategy for Japan will be independent from its other regional strategies, with the funds raised for the country as yet undisclosed.

Targeting a $200M Maiden Buy

Aiming to close an acquisition in the first quarter of next year, Kosugi told Mingtiandi that the value of Greystar’s first Japan deal will be somewhere in the region of $200 million.

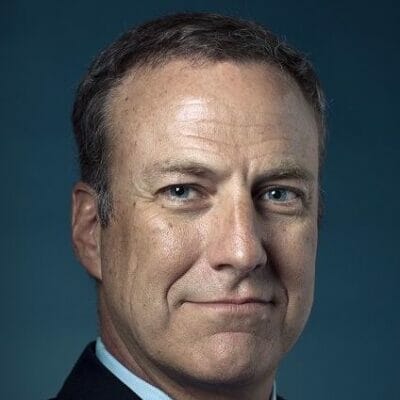

Greystar founder and CEO Bob Faith calls Japan one of the “top markets in the world” for multifamily assets

“We’re currently looking at a number of residential portfolios of a meaningful size in the major cities of Osaka, Tokyo and Nagoya to get us into the market,” Kosugi said. The company is targeting one large acquisition to establish itself in the market, followed by a number of smaller deals to complement it, the Greystar executive explained.

Depending on deal flow, the Japan team is anticipated to grow to a core of five staff, with the aim of completing three deals by the end of 2020.

Targetting Both the Mainstream and the Niches

While developers in Hong Kong and Singapore have begun exploring co-living and other innovative models, Greystar aims to stay with more conventional apartment schemes for its initial Japan projects, while innovating on the financial structures involved.

“Sixty to seventy percent of the opportunities we are looking at are in traditional multifamily assets, but we are also considering special cases,” Kosugi said, explaining that the company saw potential to acquire real estate portfolios from Japan’s giant conglomerates under sale and leaseback arrangements.

“This started a few years ago with the escalation of corporate governance in Japan, making Japanese companies much more conscious of cleaning up their balance sheets,” Kosugi said. “This presents a number of opportunities.”

The team has also identified corporate housing and student accommodation as offering considerable investment potential.

“We’re really studying the student housing sector in Japan,” Kosugi said. “There aren’t many operators in the country, but both domestic and international university students are increasing annually – the demographic looks interesting.”

In addition to these possibilities, a number of value-add development opportunities have fallen across the company’s radar.

“We’ve been looking at obsolete retail stores that are dying for capital and need a partner,” Kosugi said. “There could be an opportunity in downsizing their retail offering and potentially building multifamily above that.”

Institutional Capital Flows into Japanese Multifamily

Greystar’s entry into Japan’s multifamily market follows a wave of interest from institutional investors attracted by the country’s tradition of renting homes.

Just last week, M&G Real Estate acquired 12 residential properties in Tokyo, Osaka, Kyoto, and Fukuoka, bringing its Japanese exposure to 22 percent, according to Richard van den Berg, the manager of M&G’s Asian property strategy.

That acquisition came just over two months after European insurance titan Allianz entered the Japan market, acquiring a portfolio of 82 rental apartment properties from Blackstone for €1.1 billion ($1.2 billion).

“Japan has the largest multifamily market in Asia Pacific, supported by its strong fundamentals and healthy occupancy rates,” said Stuart Crow, capital markets CEO of JLL Asia Pacific, which represented Blackstone in the disposal.

Crow said at the time of Allianz’ acquisition in October that institutional capital was being increasingly drawn to the stable outlook, low volatility and high yields of Japan’s multifamily sector.

Leave a Reply