Xu Jiayin vows that Evergrande will join the world’s top 100 companies within three years

While sales results released in January showed that Country Garden had taken over as China’s top-ranked home builder in terms of new contracts, full-year financials released this week show that Evergrande Real Estate was China’s biggest money maker in 2017. The developer headed by billionaire Xu Jiayin earned to marks in terms of revenue after Evergrande jumped to a record RMB 311 billion ($49.7 billion) in top-line performance, as revealed in its earnings report yesterday.

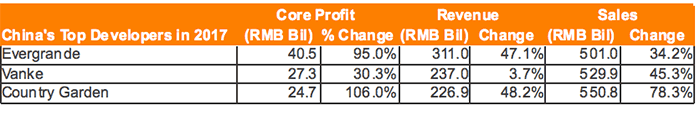

Thanks to a 47 percent increase in revenue over 2016, Evergrande’s performance outstripped China Vanke, which also yesterday reported its own 2017 revenues of RMB 237 billion, after achieving 3.7 percent annual growth. Country Garden, which had reported its financials earlier, had revenues for 2017 of RMB 226.9 billion.

Evergrande Tops Rivals in Core Profit

Guangzhou-based Evergrande which ranked third in terms of contracted sales last year, saw its core profit jump 95 percent to a record RMB 40.51 billion ($6.5 billion) with the figures, which excluded revaluation gains on investment properties, beating analysts’ forecasts compiled by Thomson Reuters of RMB 27.26 billion ($4.3 billion).

In comparison, China Vanke achieved core profits of RMB 27.28 billion ($4.4 billion) last year thanks to a 30.34 percent increase over 2016,. Meanwhile, despite a 106 percent climb from the previous year, Country Garden recorded core profit of RMB 24.7 billion ($3.9 billion) in 2017.

State-owned China Overseas Land & Investment, the country’s top property developer by market value, also reported earnings Monday with a 9.21 percent rise in core profit to HK$34.26 billion ($4.37 billion). Its revenue grew a modest 1.2 percent to HK$166.04 billion ($21 billion).

Source: stock exchange filings

Evergrande Vows to Join World’s Top 100 Companies

These cheerful 2017 results seem to have boosted Evergrande’s ambition. Xu Jiayin said in an earnings conference in Hong Kong Monday that his company aims to be among the world’s top 100 companies by revenue within three years, which requires Evergrande to achieve a 60 percent increase in sales.

Xu also vowed to reach RMB 800 billion ($128 billion) in contracted sales by 2020, according to local media reports.

Evergrande achieved its 2017 financial performance despite falling short of Country Garden’s mark for contracted sales. The Foshan-based builder saw a record RMB 550.8 billion ($88 billion) in new sales agreements last year, ahead of China Vanke at RMB 529.9 billion ($85 billion) and Evergrande’s RMB 500.96 billion ($80 billion).

Developers Cautious on 2018 Targets

Despite its strong 2017 performance, Country Garden declined to set a specific sales target for 2018 but said that it would try its best, according to a South China Morning Post account. China Evergrande was willing to venture a prediction on its sales, but revealed a cautious target of RMB 550 billion ($87.57 billion) for this year, as compared to the RMB 501 billion it set the year before.

“If we seek 800 billion yuan in sales this year, it is also possible [to hit]. But it is unnecessary, because we have said we want to focus on profitability,” said Evergrande’s Xu, as cited by the SCMP.

Leave a Reply