BitMEX CEO Arthur Hayes has secured a posh new Hong Kong address

The second-largest bitcoin exchange globally may now be taking one of the world’s highest office rental bills after agreeing to pay a record HK$225 ($28.67) per square foot per month to lease a full floor of the Cheung Kong Center in Hong Kong’s Central district.

BitMEX, which ranks second worldwide among bitcoin and cryptocurrency trading platforms, is paying the record rate for the 20,000 square foot 45th floor of the Cheung Kong Center, CK Asset’s prime office building on Queen’s Road in Hong Kong’s traditional business district, according to an account in the South China Morning Post. Renting the full floor at that rate means that BitMEX, which lists Hong Kong as one of its primary locations globally, is paying a hefty HK$4.5 million ($573,000) per month to park its cryptocurrency business at the posh location.

The premium rent buys the four year old company the right to put the same street address on its name cards as is used by some of the biggest names in finance, including Goldman Sachs, Bank of America Merrill Lynch, Barclays Capital, BlackRock, McKinsey & Co and PricewaterhouseCoopers. The record setting lease may also give some insights into what tenants coveting a prime Hong Kong address may need to pay for new office leases in the city’s top business district in the months to come.

Aiming for the Priciest Slice of the Most Expensive Market

According to a CBRE report issued last month, Hong Kong’s Central now ranks as the world’s most expensive place to rent an office for a third consecutive year. Office space in Central now costs $306 per square foot per year on average, which is 30 percent higher than the second highest location globally, London’s West End.

CK’s Cheung Kong Center now boasts the city’s highest rents

Tenants in the Cheung Kong Center, which is the flagship building of Li Ka-shing’s CK Asset, pay an average of HK$170 per square foot per month for the Central location, according to agency data, however, office rents have been rising rapidly in recent months due to a paucity of supply and growing demand from mainland Chinese occupiers.

“The rent is obviously a new high for Cheung Kong Center but I don’t think it comes as a surprise as a number of landlords are now asking for monthly rents at HKD 200 per square foot threshold,” Denis Ma, the head of research at JLL, told Mingtiandi.

The brutal competition for space has driven vacancy levels for office space in Central down to around 1.5 percent this year, however, the situation for prime locations is tighter, with vacancies for the super-grade-A segment narrowing to a record low of 0.4 percent at the end of July, according to JLL data.

For BitNEX, there are not many choices if they want to base in the city’s most prestigious area. “Limited supply and limited option in Central if they would like to go for office expansion,” said Thomas Lam, senior director at Knight Frank.

Ma said Cheung Kong Center is one of the seven buildings in Central classified by the broker as prime office premises. “The office also enjoys full sea views, which would’ve contributed to the premium,” said Ma. “A rental of HK$225 per square foot would be 50 percent ov er the average rent of HK$150 in Prime Central as of Q2 2018,” said Reed Hatcher, Head of Research for Hong Kong at Cushman & Wakefield.

The crypto-trading platform may even have saved a few real-world dollars by taking its lease now, as insiders predict that office costs in the city will continue to rise in coming months. “Our forecasts are for Grade A office rentals in Prime Central to continue to climb by 4-5% in the second half of 2018,” Hatcher said.

Letting Traders Buy on Margin Earns Prestige Address

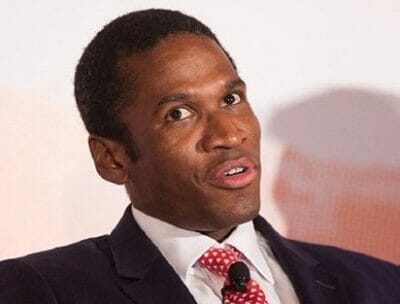

BitMEX has grown quickly in this year in terms of users and exchange options. The cryptocurrency exchange, co-founded by former Citigroup trader Arthur Hayes in 2014, has 55 employees in LinkedIn at present. The P2P trading platform has achieved enviable returns by offering futures contracts on many large-cap cryptocurrencies and by provider traders with the opportunity to buy cryptocurrencies with up to 100 percent leverage.

According to Coinmarketcap, BitMEX accounted for 28.96 percent of the market volume for cryptocurrency trades and at times handled as much as $3 billion in crypto transactions in a 24 hour period.

Leave a Reply