China Vanke, the mainland’s largest developer by sales, has signed an agreement with Shenzhen’s subway operator to buy a portfolio of sites from the state-owned firm in exchange for Vanke shares.

Baoneng’s takeover bid has brought some tense moments for Vanke chief Wang ShI (right) and his team

The deal, which is valued at up to RMB60 billion ($9.22 billion) would make Shenzhen Metro Group the largest shareholder in Vanke, effectively ending an attempted hostile takeover of the developer by Shenzhen conglomerate Baoneng Group.

The assets for shares swap would give Vanke access to a large portfolio of sites estimated at 4.5 million square metres, located above Shenzhen’s metro stations. The southern Chinese city is currently undergoing a housing boom that has seen average home prices rise more than 50 percent in the last year.

Vanke Fends Off Baoneng Takeover Bid

The agreement between Vanke and Shenzhen Metro, which was announced over the weekend, ends a rare takeover drama that began when subsidiaries of Baoneng began buying up shares in China Vanke in early December.

Although China’s real estate market has been slowing down in recent years, Vanke stands out as a prize not only for its scale, but also its profitability. In 2015 financial returns posted to the Hong Kong stock exchange on Sunday, Vanke said that it had achieved a 15 percent annual increase in profits, and net income rose to RMB 18.1 billion ($2.8 billion).

Unlike most Chinese developers, which are typically majority owned by either the government or by the company founders, Vanke’s largest shareholder, before Baoneng took a controlling stake in recent months, had been state-owned investment firm China Resources Group. Senior management and employees control only about 5 percent of Vanke.

Following the deal with Shenzhen Metro, the state-owned transportation firm will hold an estimated 20 percent of Vanke, with Baoneng retaining an 18.7 percent stake and China Resources 11.8 percent.

Deal Gives Vanke Chance to Grow with China’s Southern Hub

While diluting shareholders, Vanke’s tie-up with Shenzhen metro gives the developer, which is headquartered in the southern Chinese metropolis, a clear path to expand in China’s hottest urban property market.

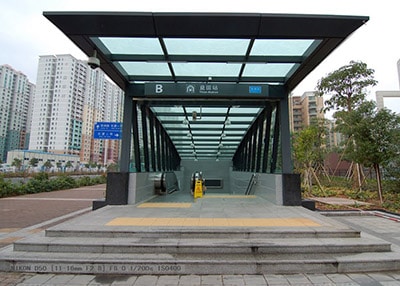

As part of the deal, Vanke will gain 4.5 million sqm of sites above Shenzhen’s metro stations

While a complete list of Shenzhen Metro’s project sites has not yet been revealed, the company operated 131 metro stations at the end of 2015, and has plans to grow that network to a total of 371 stations by 2030, according to Credit Suisse analyst Jinsong Du. Municipal metro developers in China typically are able to displace local farms, residents and enterprises from land above station sites as part of infrastructure development, and then convert that land for commercial or residential projects.

Shenzhen saw new home prices rise 508.5 per cent between 2006 and 2015, according to research by Tsinghua University and the Lincoln Institute of Land Policy. Last year the southern commercial hub surpassed Beijing and Shanghai to become the mainland’s most expensive housing market, according to official figures on average home prices.

Formerly a fishing village before China’s economic reforms turned it into a laboratory for liberalised business practices, Shenzhen’s property market has benefitted from the city’s development as a tech centre, as well as its proximity to Hong Kong. In addition to being home to Vanke and China Resources, Shenzhen also hosts the headquarters of tech giant Tencent and telecom manufacturer Huawei.

The deal also provides Vanke with support from an old friend. The publicly listed developer started out as a unit of the Shenzhen government more than 30 years ago, according to an account in the Wall Street Journal, before later being spun off during China’s privatisation drive.

Leave a Reply