Police protecting an Evergrande office

China Evergrande Group on Tuesday morning said it was engaging outside advisors to assess its liquidity as it acknowledged that its already shaky finances have begun a downward spiral as buyers shun its available homes and creditors swarm.

“The Company expects significant continuing decline in contract sales in September, thereby resulting in the continuous deterioration of cash collection by the Group which would in turn place tremendous pressure on the Group’s cashflow and liquidity,” Evergrande chairman Xu Jiayin said in a statement to the Hong Kong exchange.

Houlihan Lokey China Ltd and Admiralty Harbour Capital Ltd will assess the group’s capital structure, evaluate the liquidity of the group and “explore all feasible solutions to ease the current liquidity issue and reach an optimal solution for all stakeholders as soon as possible”, Xu added.

However, with the company’s own employees protesting in its headquarters and creditors suing in the courts, analysts believe that the time for Evergrande to solve its problems without government intervention may already have passed.

“By this stage, it is usually too late to resolve the problem internally,” Michael Pettis, a professor of finance at Peking University’s Guanghua School of Management, commented on Twitter on Tuesday. “Revenues will drop further, efficiency will decline, debt-servicing costs will rise, and liquidity will be further squeezed as potential buyers refuse to leave deposits and suppliers refuse to serve Evergrande except for cash upfront.”

Employees Protest at Evergrande HQ

Xu announced the appointment of restructuring advisors today as security guards linked arms around his headquarters in Shenzhen following days of angry protests in the building as buyers of Evergrande’s wealth management products, including many of its own employees, demanded payment and caused scenes that quickly circulated on social media.

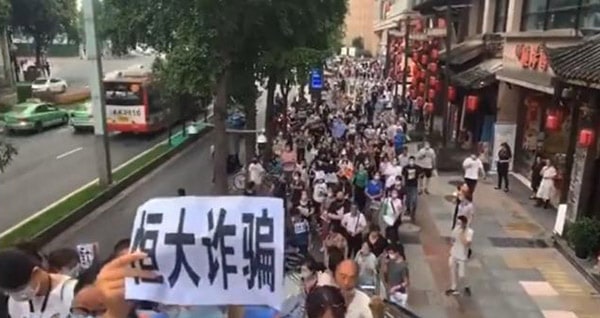

Protestors marching on Evergrande’s office over the weekend

The protests preceded Xu’s admission in the announcement today that two of Evergrande’s subsidiaries had “failed to discharge their guarantee obligations as scheduled” for RMB 934 million ($145 million) in wealth management products issued by third parties, saying that the company “is in active discussion with issuers and investors with a view to reaching a mutually agreeable repayment arrangement”.

He added that the group risked cross-default on its existing financing arrangements and creditors demanding acceleration of repayment if it failed to meet its guarantee obligation or to repay any debt when due or agree with the relevant creditors on extensions of such debts or alternative agreements.

Concerning Reassurances

Before the latest disclosures, the world’s most indebted developer had released a statement on its website Monday night in a bid to calm the rising storm and quash internet rumours about the group’s imminent collapse.

Protestors inside Evergrande offices

“The recent online remarks about Evergrande’s bankruptcy and reorganisation are completely untrue,” the statement said. “The company has indeed encountered unprecedented difficulties, but the company resolutely fulfils its corporate responsibility, goes all out to resume work and production, guarantee the delivery of buildings, do everything possible to resume normal operations, and fully protect the legitimate rights and interests of customers.”

Pettis, who is also a nonresident senior fellow in the Carnegie-Tsinghua Center for Global Policy, saw the reassurance as cause for concern.

“It’s always a bad sign when a businesses must officially deny rumors of bankruptcy,” he tweeted, estimating that a resolution is only weeks or days away. “To postpone it much longer means more angry employees, clients and investors, more losses for Evergrande, and greater financial distress costs to the economy.”

Evergrande’s HKEX-listed shares plunged nearly 12 percent in Tuesday trading and are down about 75 percent in the year to date.

Analysts Turn the Page

Whatever fixes Evergrande’s new advisors come up with, events appear to have overtaken the group, as market analysts and commentators are already openly speculating about its next incarnation.

Iris Chen, a credit analyst at Nomura International Hong Kong, told Bloomberg on Monday that a debt restructuring was “almost unavoidable”. She laid out a “base case” in which Evergrande delivers homes and pays suppliers under a state-supervised deal and dollar-debt investors get 25 percent of their money back.

Anne Stevenson-Yang, co-founder and managing principal at J Capital Research, said in an opinion piece at Forbes.com that the government is likely to force a restructuring.

“Non-core and especially overseas assets will be hived off and sold at whatever the market will bear,” said Stevenson-Yang, whose financial advisory firm specialises in sniffing out fraud at publicly traded companies in China. “Chinese individual investors in Evergrande’s wealth management products and empty apartments will lose their shirts. When they object, they will be silenced.”

The South China Morning Post reported Monday that Evergrande is offering three repayment methods to its wealth management investors.

They can choose to receive repayments through cash instalments, accepting 10 percent of their principal and interest of matured products now and the remainder through 10 percent instalments each quarter; they can accept payments through property assets; or they can use the outstanding product value to offset the balance of any Evergrande residential unit bought, the newspaper said, citing an internal memo seen by its staff.

Leave a Reply