Gaw’s red-roofed Embarcadero Square is being purchased by Blackstone (Image: Gaw Capital)

Gaw Capital is selling a San Francisco office complex that covers three city blocks to Blackstone for $245 million, according to loan application documents filed by Blackstone in the US.

Stephen Schwarzman’s New York-based firm has signed an agreement to purchase the office element of Embarcadero Square from the Hong Kong firm, some four years after Gaw had purchased the commercial space for $176 million.

The deal, which has yet to be finalised, marks rising investor interest in the office market in San Francisco’s Embarcadero district, according to a report in US real estate publication The Registry, citing brokers active in the city. Should it cross the finish line, the sale of the 293,877 square foot (27,300 square metre) office complex would work out to $833 per square foot.

Blackstone has reportedly been working with investment brokerage Eastdil Secured to approach lenders for a seven-year mortgage of up to $151 million to finance the acquisition, according to US sources. Reached via email by Mingtiandi, officials at Gaw Capital declined to comment on the transaction.

Revitalising a San Francisco Project

Embarcadero Square was known as Golden Gateway Commons until Gaw renamed the property next to San Francisco’s Sydney Walton Square in 2015. The mixed-use property has condominiums on the upper floors and commercial space on the ground level. The transaction includes only the commercial component.

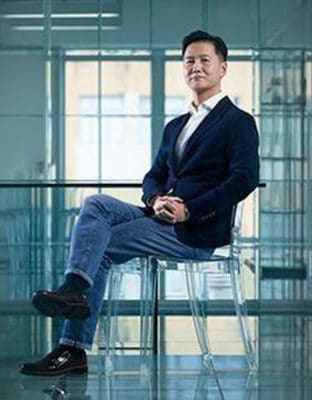

Goodwin Gaw’s private equity firm is selling its second San Francisco property of 2018

Originally developed in 1982, the grade A office complex includes three mid-rise buildings at 550 and 650 Davis Street and 75 Broadway in the Embarcadero, which are managed by Gaw US affiliate Downtown Properties. During the time that Gaw Capital has owned the property, the tenant mix has shifted from retail to office occupiers, according to a report in the San Francisco Chronicle.

Embarcadero Square is currently 90 percent occupied, local brokers reported, with tenants including insurer Esurance, CBF Electric and Data and advertising firm Bonfire Labs.

The off-market sale by Gaw comes some five months after Gaw’s Downtown Properties sold a San Francisco office building leased to WeWork to Beijing-based developer Sino-Ocean Land for $42 million. Gaw Capital currently lists eight California properties in its portfolio of 15 US assets, including the Hamm’s Building and Project Commercial in San Francisco.

Gaw Keeps US Deals Coming

In May this year, Gaw Capital closed its third US value-add real estate fund at $412 million. The company headed by Goodwin Gaw raised its first US fund in 2012 and generally targets “value-add” opportunities where it can buy less-loved properties, reposition them and resell quickly.

In June of this year Gaw Capital affiliates paid $93.5 million for an office building in the Silicon Valley city of San Jose. That deal came just two months after the private equity firm partnered with mainland investment firm Huarong Finance and developer Sino-Ocean to purchase the Soho House Chicago Hotel for $95 million.

During the same week that Gaw’s latest San Francisco deal was revealed, the company announced that it had agreed to acquire 4 and 5 Harbour Exchange in London from the UK’s Clearbell Capital for GBP 36.2 million ($47 million).

Leave a Reply