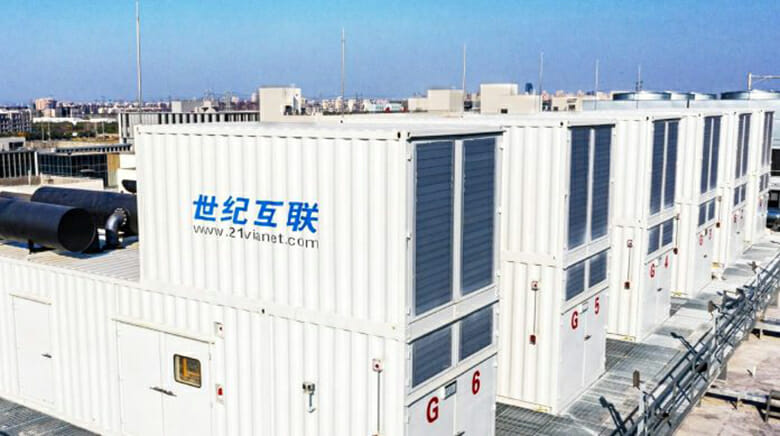

VNET operates more than 50 data centres across China

A state-run mainland investor is buying $299 million of new shares in Chinese data centre operator Vnet in a deal that will hand control of the Blackstone and GIC-backed company to the Shandong provincial government company.

A pair of subsidiaries of Shandong Hi-Speed Holdings Group, which is 100 percent owned by entities under the Shandong government, have agreed to acquire 42 percent ownership in Vnet, establishing themselves as the company’s largest shareholder with 35.7 percent voting rights, according to an announcement late last week.

“We are pleased to welcome this strategic investment from SDHG, which stands as a powerful endorsement of Vnet’s leading competitiveness and unique value proposition in the IDC industry,” said Josh Sheng Chen, founder and executive chairman of the company. “Their investment will further strengthen our balance sheet and fuel innovation as we will cooperatively explore new opportunities in renewable energies with them going forward.”

The move takes place as Vnet’s current liabilities rose to RMB 11.2 billion ($1.5 billion) as of 30 September, against cash and cash equivalents of RMB 2.7 billion. In February, Fitch Ratings had downgraded VNET’s credit from ‘B’ to ‘B-’ saying, “The downgrade reflects our view that Vnet’s liquidity is relatively weak and that it does not have the funds to meet its likely obligations over the next 12 months.”

Shandong Takeover

Shandong Hi-Speed is buying equity from a tranche of 1.5 billion new shares which Vnet had announced in October, with the placement doubling its authorised share capital.

With 35.7 percent of Vnet’s voting rights following the transaction, Shandong Hi-Speed’s control will exceed that of the company’s directors and executive officers who, prior to the share placement, collectively had 26.8 percent voting rights, according to Vnet’s 2022 annual report,

Vnet founder and executive chairman Josh Chen Sheng

Prior to the deal, US investment management giant Fidelity International was the largest institutional shareholder in Vnet with a 9.6 percent stake and 7.3 percent voting rights.

Previously seen as an opportunity for global investors to profit from the growth of China’s digital infrastructure sector, Vnet received backing from some of the world’s largest investors. Starting from 2020 Blackstone invested $400 million in Vnet including purchasing $150 million worth of shares in the company in June of that year.

In February 2022, funds managed by Blackstone also agreed to invest $250 million in convertible notes issued by Vnet. In its February statement Fitch said that Vnet had $600 million in convertible notes outstanding which were set to become puttable in February 2024.

According to a report by financial data provider Fintel, Singapore’s GIC also invested in Vnet, with the sovereign fund holding 45.2 million shares in the company as of February, giving it a 5.3 percent stake at the time. That stake was down from 75.4 million shares in February 2022.

Hong Kong-listed Shandong Hi-Speed Holdings Group is 70 percent owned by the Shandong State-owned Assets Supervision and Administration Commission (SASAC), 10 percent by the Shandong Provincial Council for Social Security Fund and 20 percent by Shandong Guohui Investment Holding Group, according to Fitch. As of 30 December, Shandong Hi-Speed had total assets of around HK$69 billion focused on investments in the industrial sector and energy infrastructure.

Chinese Data Centres Decline

The Vnet takeover comes three months after the company’s Nasdaq-listed competitor, Chindata, was taken private by its major shareholder, US private equity giant Bain Capital, in a $3.16 billion deal.

GDS Holdings, another Nasdaq-listed Chinese data centre operator, has seen its shares plummet from around $116 in February 2021 to $11.96 each on Tuesday.

The decline in shares of foreign-listed mainland data centre stocks coincides with the Chinese government’s tech sector crackdown that has seen authorities increase scrutiny of major Internet companies.

Leave a Reply