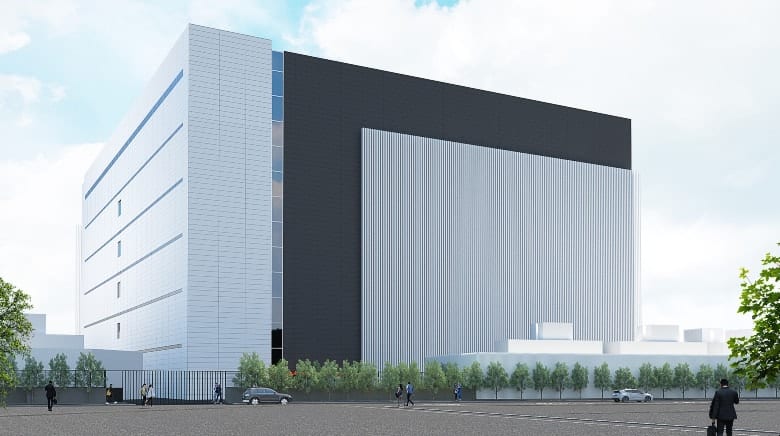

A rendering of Lendlease’s first data centre project in Saitama, Japan

Lendlease has launched its first data centre project in Japan, with the Australian developer promising a facility among the largest in Asia’s most developed economy as it puts a two-year-old investment fund into gear.

The hyperscale data centre will occupy a 33,000 square metre (355,209 square foot) site in Greater Tokyo and provide more than 60,000 square metres of gross floor area, close to half of which has been pre-leased, Sydney-based Lendlease said Monday in a press statement. While the company has yet to release details of the project location, it is understood to be in Saitama, a prefecture about 25 kilometres (15.5 miles) northwest of central Tokyo.

“This project is of significant scale in a sector of growing importance in the digital economy, leveraging our more than 20 years’ experience in the local communications and data infrastructure space, as well as Lendlease’s broader presence in Japan for over 30 years,” said Andrew Gauci, managing director of Japan and head of telecoms and data infrastructure for Asia at Lendlease.

The announcement ends a two-year lull for Lendlease’s data centre strategy, which was launched as a $1 billion fund in July 2019 but had yet to unveil a project before today.

Idle Fund Unleashed

Phased development for Lendlease’s breakthrough project will begin later this year, with the initial phase scheduled for completion by early 2024.

Lendlease Asia CEO Justin Gabbani has finally landed his first DC deal

“This partnership is an exemplar of our updated strategy in action, leveraging our competitive edge and creating value with our partners,” said Justin Gabbani, Lendlease’s chief executive for Asia. “With our end-to-end integrated capabilities, we look forward to building on this to explore further investments in the future.”

The gross development value of the project — the first under the 2019-vintage Lendlease Data Centre Partners fund — will exceed A$800 million ($600 million) upon completion of all phases, the company said.

The $1 billion LLDCP fund was set up about two years ago with an initial equity commitment of $500 million. The vehicle is 20 percent funded by Lendlease and 80 percent by an undisclosed institutional investor believed to be from Singapore, the Australian Financial Review reported.

The fund’s mandate covers investment in completed assets and new development opportunities in Australia, China, Japan, Malaysia and Singapore, with Lendlease handling development and construction, as well as property and investment management, for projects acquired under the strategy.

Aiming to accelerate the growth of its data centre platform across major markets, Lendlease in March 2020 announced the hiring of former Global Switch managing director Sam Lee to lead LLDCP.

In July 2020, Lendlease was reported to be among the bidders for a Telstra data centre in Melbourne, but that 12-megawatt facility was ultimately won by Australia’s Centuria REIT for $300 million.

Sweet Spot for Bit Barns

Lendlease praised Japan as a hub for hyperscale cloud computing, with the country’s connectivity and distribution advantages helping to drive demand from data centre service providers.

A survey published earlier this year by Arcadis ranked Japan as the third most attractive market globally for developing data centres, with the Dutch design consultancy crediting the country’s high rate of mobile broadband penetration and large-scale adoption of digital technologies by businesses.

Last month, Japanese finance giant Mitsui revealed a $319 million commitment from the Canada Pension Plan Investment Board to invest in a newly launched fund for the development of hyperscale data centres in the country.

In June, Singapore-based Princeton Digital Group announced a $1 billion plan to build a 97MW data centre, which like Lendlease’s new project will be located in Saitama prefecture. In March, US giant Equinix opened its first hyperscale facility in Asia in the Japanese capital.

Leave a Reply