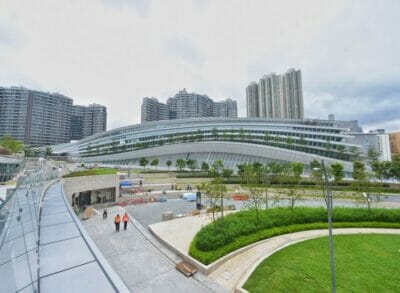

Hong Kong’s busy West Kowloon station.

Leading today’s top real estate stories from around the region, developers from Hong Kong and the mainland may soon be scraping up their change to bid for a prime commercial site atop Hong Kong’s high-speed rail terminus which could sell for HK$100 billion in the first half of this year. Meanwhile Starbucks’ China rival Luckin Coffee, which is gearing up to overtake the American coffee giant on the mainland, has tapped three banks, including Credit Suisse, to work on a US IPO sometime this year. Read on for all the details on these stories and more in Mingtiandi’s daily roundup of headlines from around Asia.

Site Over HK’s High-Speed Rail Station Could Sell for HK$100B

A prime commercial site on top of Hong Kong’s high-speed rail terminus will be sold to developers in the first half of the year, with 2019 expected to see the sale of the largest supply of floor space for offices and businesses in two decades.

The 5.88 hectare (14.5 acre) site at West Kowloon station was one of 22 residential and commercial lots on this year’s official land sale list, which was unveiled by the government on Thursday.

The expected yield of private flats from this year’s land sales and other projects, however, would be the lowest in almost a decade. Read more>>

Frasers Centrepoint Trust to Take 17% Stake in PGIM Retail Fund

Frasers Centrepoint Trust (FCT) has entered into agreements to acquire a 17.1 percent stake in PGIM Real Estate Asia Retail Fund Ltd for about S$342.5 million, subject to determination of the dividend amount payable in respect of the sale shares for the fourth quarter of 2018.

An FCT subsidiary has entered into 12 agreements with shareholders of the fund to purchase the shares in a deal which is separate from a similar transaction between Frasers Property and the PGIM fund which was announced on Feb 18th. Read more>>

Starbucks’ China Rival Luckin Coffee Taps Three Banks for U.S. IPO

Chinese startup Luckin Coffee, which has ambitions to overtake Starbucks in mainland China this year, has tapped three banks including Credit Suisse to work on a US IPO in 2019, said people with direct knowledge of the matter.

Goldman Sachs and Morgan Stanley are also advising Luckin, one of the quickest firms to reach ‘unicorn’ status in China, on preparatory work for the initial public offering (IPO), said the people. One of the sources said the company is targeting a valuation of about $3 billion in the IPO. Read more>>

India’s Chalet Hotel Eyes Distressed Assets, More Hotel Brands

Real estate firm K Raheja Corp’s hospitality arm Chalet Hotel Ltd, which recently raised INR 16.410 billion ($231.7 million) through an IPO, is eying distressed hotel assets and acquiring more hotel brands to expand its portfolio, said a top company executive.

The Indian company is currently in talks with multiple hotel owners to buy out existing hotel properties in Pune, the National Capital Region and Chennai to enter these markets. Read more>>

Evergrande Sets Up New EV Firm Following Botched Faraday Future Deal

Chinese real estate giant Evergrande has set up a new energy vehicle company with four wholly owned subsidiaries, the latest in a series of moves that sees the company increase its focus on electric cars.

Evergrande New Energy Vehicle Company was established in the southern Chinese city of Guangzhou on January 25th with a registered capital of $2 billion, according to public records. A month later, it changed its name to Evergrande National New Energy Vehicle Group. The company will focus on energy technology research, engineering, and the sale of auto parts. Read more>>

Alibaba to Start Work on $1 Billion Beijing HQ in November

Alibaba will start construction on a CNY 6.9 billion ($1 billion) headquarters building in Beijing this November for completion in 2024.

The Hangzhou-based e-commerce heavyweight will build the 470,000 square metre facility in the capital’s Chaoyang district, the municipal government said on its website. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply