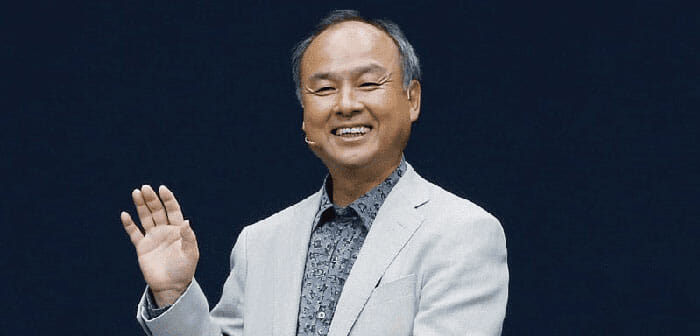

Softbank’s Masa Son waves a cheerful goodbye his cash

Masayoshi Son’s Softbank leads Mingtiandi’s collection of real estate stories today as the Japanese tech investment firm announces that it expects to record a $6.6 billion loss on its gamble on ill-fated co-working provider WeWork.

Also in the headlines, the number of homeowners underwater in the world’s most expensive housing market tripled during the first quarter, and in another sign of distress in Hong Kong, as restaurants, pubs and clubs in the city’s trendy Soho area remain shuttered, potential buyers are demanding 30 percent discounts as local landlords struggle to collect rent. All these stories and more are in Mingtiandi’s headline roundup.

Softbank Plans to Book $6.6B WeWork Loss

SoftBank Group Corp (9984.T) said it sees a loss of around 700 billion yen ($6.6 billion) for the year ended March on the portion of its WeWork investment held outside the Vision Fund, as the virus compounds woes at one of the firm’s biggest bets.

The hit extends the group’s expected net loss to 900 billion yen as investments made via the $100 billion fund sour, with the latest writedown illustrating how the group is racing to keep pace with the deteriorating value of its portfolio. Read more>>

Count of HK Homeowners in Negative Equity Tripled in Q1

The number of residential mortgages in negative equity – where the outstanding loan amount exceeds the current market value of the underlying property – tripled to 384 at the end of March from end-2019, the Hong Kong Monetary Authority said on Wednesday. That is the highest level since 1,307 in the second quarter of 2016.

While the number came below market expectation, the industry could see higher count in the current quarter as unemployment increased and economists maintained bleak forecasts for the city’s economy. Read more>>

Potential HK Shopbuyers Asking 30% Discounts for Vacant Soho Venues

Shop owners in SoHo, one of Hong Kong’s most bustling nightlife districts, are willing to offer steep discounts on their asking prices as an increasing number of restaurants and bars remain vacant in the current economic downturn, market observers say.

According to Midland IC&I, only 168 deals for shops were recorded in the first quarter in Central, which includes SoHo. The commercial property agency said that it was the worst ever quarter since it started tracking transactions in 1996. Nearly a quarter of the 138 shops in Staunton Street and Elgin Street, known for restaurants offering a range of international cuisine from Indian to Italian, are sitting empty, it said. Read more>>

Simon Property Prepares to Re-Open 49 US Malls Amid COVID Crisis

Simon Property Group, the biggest operator of malls in the United States, has come up with a game plan for reopening 49 shopping centers across 10 states starting on Friday.

Security officers and employees will “actively remind and encourage shoppers” to maintain a proper distance from others and to refrain from shopping in groups. Food court seating will be spaced to encourage social distancing, and reusable trays will be banished. Play areas and drinking fountains will be temporarily closed, mall-provided strollers won’t be available and, in restrooms, every other sink and urinal will be taped off. Regular audio announcements will be made “to remind shoppers of their part in maintaining a safe environment for everyone.” Read more>>

Singapore Extends Tender for Housing Site to 6 Months

In the first government land sale (GLS) in 2020, the Housing Board on Thursday (April 30) put on the market an executive condominium site in Yishun Avenue 9, and extended the public tender period to six months because of the coronavirus outbreak.

The tender for the 99-year leasehold land parcel will close at noon on Oct 29.

Tenders for GLS sites usually range from six to eight weeks. The longer duration for the Yishun site will provide developers with additional time to make their assessment in view of the current Covid-19 situation, HDB said in a media release. Read more>>

Hongkong Land Boost Q1 SG Sales to $170M

Property developer Hongkong Land’s attributable interest in contracted sales of development properties in Singapore for 1Q2020 came in at US$170 million ($241 million), compared with US$116 million in 1Q2019. This is according to an interim management statement the company released on April 28.

In Singapore, it has two residential development projects through its subsidiary MCL Land, namely, Margaret Ville and Parc Esta. However, the group states that market sentiment in the country has become more cautious and construction activities have been suspended. Read more>>

SPH REIT Refinances S$280M Loan with OCBC

SPH REIT Management Pte. Ltd., in its capacity as the manager of SPH REIT announced on Wednesday that it had secured the refinancing of an existing loan of S$280 million due in July 2020, for a new term of five years from Oversea-Chinese Banking Corporation Limited (OCBC).

The company said that, in line with its capital management strategy, the 5 year tenure will the REIT manager to ensure that the trust’s debt maturity profile is well staggered, without major concentration of debts maturing in any single year. SPH REIT’s balance sheet currently has a gearing remaining of approximately 29.3%, with no other refinancing required until June 2021. Portfolio weighted average debt term to maturity is expected to increase from 2.2 years to 3 years following the refinancing. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply