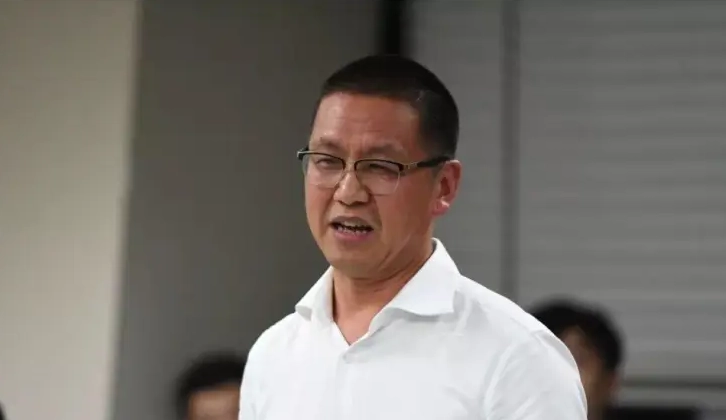

Dexin China chairman Hu Yiping seems to have just lost his chair

The liquidation of yet another mainland developer leads Mingtiandi’s headline roundup today as Dexin China is ordered wound up. ESR is also in the news as it looks to sell a Sydney data centre site and WeWork names a new CEO as it emerges from bankruptcy.

Dexin China Holdings Ordered to Liquidate in Hong Kong

Dexin China Holdings has joined the growing list of troubled Chinese developers facing liquidation as impatient creditors take them to court in an attempt to claw back the money they are owed.

The Zhejiang-based developer received a winding-up order from a Hong Kong court on Tuesday, Bloomberg reported. China Construction Bank (Asia), the trustee of Dexin’s bondholders, filed the petition three months ago as it sought repayment of a note worth US$350 million plus interest that was due in 2022. Read more>>

ESR Said Marketing Sydney Data Centre Site for Residential Development

Asian warehousing giant ESR has become the latest group to cash in on the boom in the accommodation sector, putting a business park in Macquarie Park in Sydney on the block for more than A$100 million ($66.1 million).

Rather than join rivals Goodman and Stockland in rezoning sites, it is looking to sell 44-50 Waterloo Rd, which it picked up three years ago from an AMP fund for A$71 million and which it earmarked for a data centre. Read more>>

WeWork Emerges From Bankruptcy, Announces John Santora as CEO

WeWork, the shared office company once valued at $47 billion, emerged from bankruptcy on Tuesday and named Cushman & Wakefield executive John Santora as its new CEO.

WeWork filed for Chapter 11 bankruptcy protection in November, with total liabilities of $18.65 billion against assets of $15.06 billion. The COVID pandemic, which led to a surge in vacancies, coupled with an economic slump and steep downturn in tech valuations, contributed to WeWork’s troubles. Read more>>

Shanghai Scraps Caps on Land Sale Premiums

Shanghai will no longer set a limit on land auction premiums, which the local government introduced three years ago, and will revert to accepting the highest bid.

City authorities published information at the end of last week on four plots of land for auction covering an area of about 15.3 hectares (37.8 acres) and with a combined starting price of RMB 8.4 billion ($1.2 billion). The highest bidder will win, it was noted. The auction is the third this year. Read more>>

Tokyo Apartment Building to Be Demolished for Blocking View of Mount Fuji

A newly constructed residential building in suburban Tokyo will be pulled down the month before the apartments were due to be handed over to buyers, after incensed locals complained the structure blocked their views of Mount Fuji.

The 10-storey apartment building on Fujimi Street — whose name translates to “Fuji view” — in the suburb of Kunitachi comprises 18 housing units, which range in price from JPY 70 million yen to JPY 100 million ($440,000 to $640,000), according to the builder Sekisui House. Read more>>

SHKP Selling Tuen Mun Flats at 15% Discount to 2023 Price

Sun Hung Kai Properties unveiled the first price list for Phase 3B of Novo Land in Tuen Mun on Tuesday, offering 154 flats about 15 percent cheaper on average than a year ago.

The flats cost an average of HK$11,598 ($1,484) per square foot after discounts, 14.7 percent lower compared with prices in Phase 2A, which was launched in May of last year. Read more>>

Singapore’s HDB Announces Plans for New Housing Area in Yishun

Singapore’s Housing and Development Board has released further details of the master plan for Chencharu, the new housing area in Yishun.

The plans include a park, a mixed-use integrated development with a bus interchange, as well as a bus-only road — Chencharu Link — for public transport connectivity within and outside of Yishun town, the HDB said Wednesday. The first build-to-order project in Chencharu will be launched in June. Some 1,270 units of the project will comprise a mix of two-room flexi to five-room flats. Read more>>

BlackRock Expanding Japan Business to Handle Inbound Foreign Investment

BlackRock’s Japan unit plans to expand its offerings of investment options in the country for overseas clients.

In order to attract foreign funds, the company has increased the number of portfolio managers, analysts, strategists and other personnel involved in the active management of Japanese equities by approximately 20 percent since last year, said Hiroyuki Arita, CEO of BlackRock Japan. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on X, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply