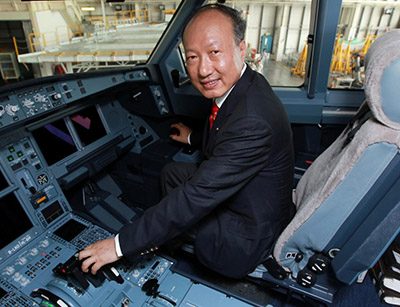

HNA chairman Chen Feng is losing control of the plane

HNA’s increasingly turbulent flight path leads the way in Mingtiandi’s roundup of Asia real estate headlines today with news of trouble in the cockpit as long-haul flights at Hong Kong Airlines may be axed, while bounteous fund raising by mainland developers is making regulators twitchy.

In other news around the region, an investment firm linked to one of Korea’s biggest companies has snapped up a €691 million office asset in France, while an Amazon-leased building in Slovakia has tempted another Seoul-based company.

Elsewhere, a Singapore sovereign wealth fund joint venture is ready to build a 2.5 million square foot shopping mall, the biggest ever in India, and a Hong Kong mansion is set to become the most expensive home in Asia, if it sells for the HK$33.8 billion asking price.

HNA-Backed HK Airlines Set to Axe More Flights

Troubled Hong Kong Airlines revealed on Monday that it was reviewing its entire route network and had not ruled out axing all long-haul flights.

The carrier, backed by mainland Chinese conglomerate HNA Group, has been beset by a raft of financial, legal and shareholder challenges for months. Read more>>

Regulator Halts Developer Bond Sales in China

A Chinese regulator has suspended bond issuance from some of the nation’s developers in a bid to curb excessive fundraising by the sector, according to people familiar with the matter.

The National Association of Financial Market Institutional Investors, a unit under China’s central bank, has since last week halted some builders’ debt sales via window guidance, said the people, who are not authorised to speak publicly and asked not to be identified. Read more>>

Samsung Partnership Acquires €691M Office in France

A property arm of French asset manager La Française has expanded its partnership with its South Korean partners via a €691 million ($788 million) office acquisition deal.

La Française Real Estate Partners and Samsung Securities have agreed to buy the seven-story Crystal Park office building located 62-64 boulevard Victor Hugo, in Neuilly sur-Seine (92), from listed commercial property investor ICADE. Read more>>

Mirae Backs €120M Amazon Building Acquisition in Slovakia

Mirae Asset Daewoo and NH Investment & Securities have participated in a €120 million ($134 million) acquisition of an Amazon-leased building in Slovakia as limited partners, which marks the first entry by South Korean capital into the Slovak real estate market.

Online retailer Amazon is the main tenant under a 10-year lease. Read more>>

Singapore GIC-DLF JV to Build Biggest Ever Mall in India

Singapore sovereign wealth fund GIC is strengthening its alliance with India’s largest listed realty developer DLF as it seeks to participate in helping build the country’s biggest retail mall of more than 2.5 million square feet (232,000 square metres), said two people with direct knowledge of the development.

The new project, a retail and commercial-led mixed-use development to be known as Down Town, will be constructed on a 23-acre (93,000 square metre) land parcel owned by DLF in Gurugram. Read more>>

India Co-living Outfit Secures $7.2M Investment

JM Financial Private Equity’s second fund — JM Financial India Fund II — has finalised an investment in Coimbatore-based co-living operator Isthara Parks to fund the firm’s expansion plans, wherein the fund will be investing close to rupees 40–50 crore ($5.8–$7.2 million) in tranches, said two people aware of the development.

The quantum of stake acquired by the fund is not yet clear but sources in the know indicated it is a significant minority stake. Read more>>

Hong Kong Mansion Set to Be the Most Expensive Ever in Asia

Christie’s International Real Estate has listed a rare and stunning stand-alone home on Middle Gap Road — one of the most prestigious gated communities in the city—on The Peak.

The asking price is HK$33.8 billion ($447.8 million), making it the most expensive home currently for sale in Hong Kong, surpassing the 28 Gough Hill Road property Pansy Ho bought last year for HK$900 million ($114.6 million). Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply