ESR REIT’s acquisition of 46A Tanjong Penjuru has not been popular with investors.

In our latest roundup of regional news headlines, Singapore-listed ESR-REIT’s share price takes a hit after some recently announced financial plans, and Shenzhen surges past world capitals in the league table of luxury home prices.

South Korean investors also make the news, as the pandemic is reported to have reduced cross-border real estate investment in and out of the north Asian nation by 24 percent last year.

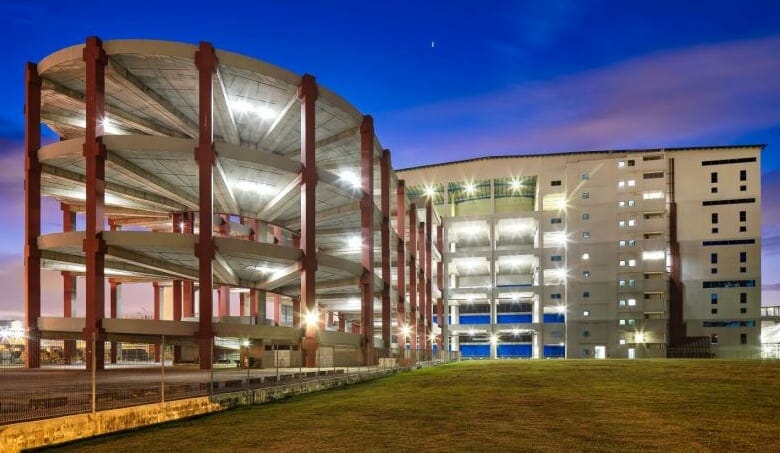

ESR-REIT Shares Tank on Asset Acquisition Plans

Shares of ESR-REIT hit a five-month low on Friday amid heavy trading, one day after the manager announced plans to raise about S$150 million ($112.7 million) to fund a Singapore acquisition and asset enhancement initiatives.

The REIT also obtained a S$68.5 million unsecured loan to finance the acquisition of a 10 percent interest in a GIC-majority-owned Australian logistics investment for A$60.5 million ($47 million). Read more>>

Shenzhen Luxury Home Price Growth Outpaces HK, London and Paris

Mainland China’s tech hub of Shenzhen recorded the fastest growth in luxury home prices in the world in the first quarter, up 18.9 percent on the same period a year ago and beating traditional prime property markets such as Hong Kong, London, New York and Paris, according to property consultancy Knight Frank.

Chinese cities Shanghai and Guangzhou also came second and third in the list of 46 cities, registering price growth of 16.3 percent and 16.2 percent respectively. Shenzhen and Guangzhou are two of the 11 cities in Beijing’s integrated economic and business hub initiative for the Greater Bay Area. Read more>>

Lendlease Global REIT’s Q3 Portfolio Occupancy Holds Steady at 99.7%

Lendlease Global REIT on Friday said its portfolio occupancy stood at 99.7 percent as of 31 March, down by a marginal 0.1 percentage point from a year earlier and unchanged from the previous quarter.

In a third-quarter business update issued on Friday, the manager said the REIT’s portfolio’s weighted average lease expiry (WALE) for the period stood at nine years by net lettable area (NLA) and 4.6 years by gross rental income (GRI). This was down from its WALE of 9.3 years by NLA and 4.9 years by GRI as of 31 December 2020. Read more>>

Far East Orchard Posts Q1 Loss of S$700,000

Singapore-listed property player Far East Orchard sank into the red in the first quarter as the COVID-19 pandemic battered its hospitality business.

Net losses came to S$700,000 ($525,900 now) for the three months to 31 March, reversing earnings of S$900,000 in the year-ago period, the group said in a business update on Thursday. Read more>>

Pair of Conservation Shophouses for Sale on SG’s Neil Road

Two adjoining three-storey conservation shophouses at 73 and 75 Neil Road have been put up for sale via expression of interest with a collective guide price of S$30 million ($22.5 million), exclusive marketing agent CBRE said Thursday.

Sitting on a land plot of about 4,439 square feet (412 square metres), the pair has a total gross floor area of 11,128 square feet, a courtyard of 825 square feet and a main road frontage of about 11 metres. This amounts to about S$2,510 per square foot on the floor area. Read more>>

Frasers Property Thailand Debenture 4.5 Times Oversubscribed

Frasers Property Thailand issued a three-year debenture for THB 5 billion ($160 million) with an oversubscription of 4.5 times. Proceeds from the capital raised will be used to further strengthen the company’s real estate platform through investments and support capital expenditure and business operations in 2021.

The company said it received an overwhelming response from institutional investors for debenture subscriptions. The THB 5 billion debenture with fixed interest rate of 2.16 percent and three-year maturity was set to be issued on 6 May 2021. Read more>>

Two 999-Year Office Floors for Sale in Singapore’s Malacca Centre

CBRE is launching for sale two office floors — Levels 9 and 16 — at Malacca Centre, a 16-storey commercial development located in Singapore’s Raffles Place. The sale will be conducted by public tender, closing on 17 June 2021 at 3pm.

The gross floor area of Level 9 is 1,830 square feet (170 square metres), while Level 16’s GFA is 2,142 square feet. Both levels are currently occupied. Read more>>

Korean Cross-Border Investment Fell 24% in 2020

Foreign investment in the Korean commercial real estate market reached an estimated $1.9 billion in 2020, down 24 percent, while Korean outbound commercial real estate investment volume fell 39 percent to $6.3 billion in 2020, according to CBRE’s 2020 Korea In and Out report.

The decline in cross-border investment was primarily due to the COVID-19 pandemic. Intense competition from domestic buyers, who continued to be supported by abundant liquidity, also inhibited acquisitions by overseas investors. But many foreign investors continued to pursue investment opportunities in Seoul, with 2020 witnessing the completion of several major office and logistics deals. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply