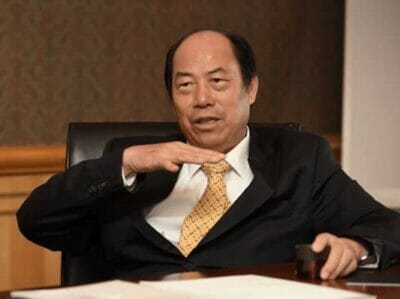

Country Garden boss Yang Guoqiang wants to top up his coffers with another $1 bil

The Market Strikes Back could be the subtitle of today’s roundup of real estate news from around the region as developers in Hong Kong struggle to sell homes amid an unexpectedly steep downturn, and mainland developers scramble to arrange new financing amid an ongoing crackdown. Read on for all the stories on who’s selling Hong Kong homes below cost and which companies are denying any Saudi ties.

Country Garden Plans $1B Convertible Bond

Country Garden Holdings Co, China’s biggest developer by sales, is planning to raise at least US$1 billion in a convertible bond sale, according to people with knowledge of the matter.

The Foshan-based company aims to sell the securities as soon as this year, according to the people, who asked not to be identified because the information is private. Proceeds will be used to help refinance convertible notes that mature in January 2019, the people said. Read more>>

Wanda Denies Report of $700M Saudi Investment in Legendary

Legendary Entertainment is hitting back at a report that Saudi Arabia’s Public Investment Fund may be exploring the possibility of acquiring a stake worth up to $700 million in the company.

A story in Reuters, citing unnamed sources, said that the Kingdom was weighing an investment and also claimed that the PIF is seeking to appoint an outside adviser to help it with the possible transaction. Read more>>

Hong Kong Projects Struggle to Sell Homes Amid Downturn

Hong Kong’s residential property market reported its worst sales weekend in years, as the wind was taken out of the sails of two private project launches by a government offer of discounted housing for first-home buyers.

The Reach Summit project in Yuen Long, jointly built by Henderson Land Development and New World Development, sold six flats as of 6:30pm, a mere 6 per cent of the 102 units on offer, sales agents said. In Tsuen Wan, MCC Real Estate Group sold five of the 50 units at its L’aquatique project. Read more>>

Country Garden, CSCEC Said Selling Hong Kong Homes Below Cost

Country Garden Holdings, China’s largest developer by sales, is bracing for a potential loss on its majority-owned residential project in Ma On Shan, as an initial batch of flats are being released at a starting price below development cost, according to analysts.

The developer said on Friday the first batch of 110 flats at the 547-unit Altissimo would be offered at a starting price of HK$13,887 (US$1,773) per square foot, after factoring in a discount of up to 14 per cent. Read more>>

Agile Group Paying 9.5% to Sell $400M Bond

Chinese property developer Agile Group is offering to pay a coupon of about 9.5 percent on a two-year dollar bond now on sale, according to a term sheet seen by Reuters, following peer KWG Group issuing a similar note for 9.85 percent.

Guangzhou-based KWG sold $400 million senior notes due 2020 on Wednesday, it said in a filing. For Agile, the document said it plans to use the proceeds to refinance existing onshore and offshore indebtedness. Read more>>

Wanda Pays Off RMB 216B in Debt After Govt Crackdown

Real estate and entertainment giant Wanda Group has paid off about 216 billion yuan ($31 billion) of debt since it was struck with liquidity crisis as a result of the Chinese government’s crackdown on “excessive” overseas investment that began last year.

In 15 months, Wanda Commercial Management Group, the major unit that runs Wanda’s real estate business, has reduced by about one-third the debt level that Wanda had in June 2017, according to fiscal reports for Wanda Commercial Management obtained exclusively by Caixin. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply