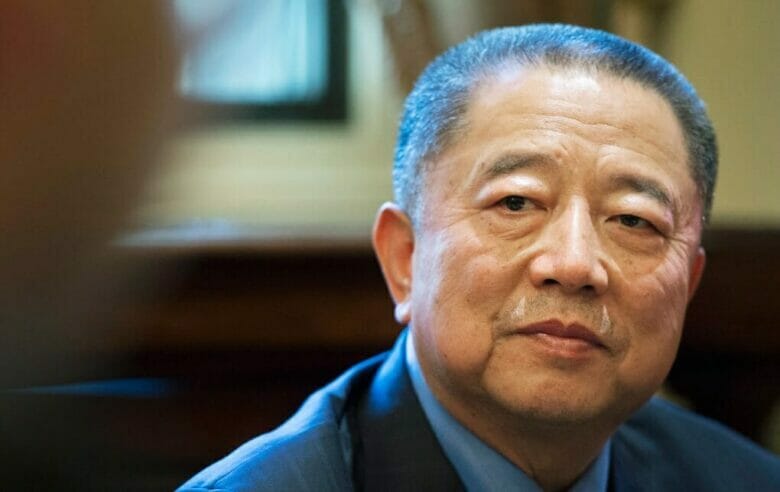

Central China Real Estate chairman Hu Baosen is adapting to the times

In today’s roundup of regional news headlines, a Chinese developer resorts to taking crops as payment for homes, heavily indebted Evergrande gets a delisting alert from the Hong Kong bourse, and Singapore’s DBS extends a sizeable green loan to sovereign fund GIC to refinance a Sydney skyscraper.

Chinese Developer Accepts Wheat, Garlic as Payment

As China’s property slump persists, one developer is trying to entice farmers to buy homes by accepting their crops as payment.

Central China Real Estate is offering to pay farmers as much as RMB 160,000 (S$33,082) for their wheat to offset down payments for homes in its River Mansion residential project in Shangqiu, a city in Henan province, according to a Monday marketing post. Weeks ago, the company offered to accept garlic from growers looking to buy homes in another project in Kaifeng. Read more>>

Evergrande Gets Delisting Reminder From HKEX

China Evergrande, which defaulted on its dollar-denominated bonds last December, is getting an early stock delisting warning as the developer struggles to publish its audited accounts and report on a $2 billion enforcement action by lenders.

The Hong Kong stock exchange on Tuesday issued a “resumption guidance” for the Shenzhen-based homebuilder to comply with its listing rules, according to a filing, as the stock remained suspended from trading since 21 March. Read more>>

DBS Extends A$295M Green Loan to GIC for Sydney CBD Tower

DBS has extended a A$295 million ($284.3 million) green loan to Singapore sovereign wealth fund GIC for the refinancing of Chifley Tower Sydney, the bank said Wednesday.

The facility is one of the largest green loans extended by a Singapore lender in the Australia market and is also DBS’s first green loan denominated in Australian dollars. Read more>>

CapitaLand Offers ‘Buy Now, Pay Later’ Plan for Vietnam Project

Singapore’s CapitaLand Development has rolled out a “buy now, pay later” scheme for a residential project in Vietnam amid slowing residential sales in the Southeast Asian country.

CapitaLand, controlled by Singapore’s Temasek Holdings, is offering the scheme to buyers for the first time since the company entered the local market in 1994. Read more>>

IREIT Lands Major Data Centre Lease at Sant Cugat Green Property

IREIT Global has landed a new 12-year lease at Barcelona’s Sant Cugat Green for 5,300 square metres (57,049 square feet) of vacant data centre space, the REIT said in a Tuesday filing with the Singapore Exchange.

The lease would bring the property to 97.2 percent occupancy on a pro forma basis, up from 77.1 percent at the end of March, the filing said. Read more>>

Singapore Bungalow Rents for Record $144,000 a Month

The Singapore housing market is proving to be a haven for the seriously wealthy, with prices and rents charting new levels. Most recently, a Good Class Bungalow at Queen Astrid Park was let to a Chinese national at a monthly rent of S$200,000 ($144,000) or S$2.4 million a year.

Accessible via Sixth Avenue and Coronation Road West, the GCB at Queen Astrid Park sits on an elevated, freehold site of 25,439 square feet (2,363 square metres) that is largely shielded from street view. The GCB is newly completed. Read more>>

Moody’s Downgrades Lippo Malls Indonesia Retail Trust

Moody’s Investors Service has downgraded the corporate family rating of Lippo Malls Indonesia Retail Trust to B2 from B1.

Moody’s has also downgraded the backed senior unsecured rating on the bonds issued by LMIRT Capital Pte Ltd, a wholly owned subsidiary of LMIRT, to B2 from B1. The bonds are guaranteed by the trustee of LMIRT. Read more>>

Nine Office Units on Singapore’s Clarke Quay for Sale at $20M

Nine contiguous strata office units on level 17 of The Central at Singapore’s Clarke Quay have been put up for sale by expression of interest at a guide price of S$28 million ($20 million), sole marketing agent JLL said Wednesday.

This translates to about S$2,965 per square foot based on the property’s total strata area of 9,441 square feet (877 square metres). Read more>>

Mixed-Use Building in Singapore’s Newton Area Up for Sale

A five-storey mixed commercial and residential building, 200 Bukit Timah Road, has been put up for sale at a guide price of S$20 million ($14.4 million), exclusive marketing agent CBRE said Wednesday.

The freehold property, located in Singapore’s Newton precinct, sits on a land area of 2,083 square feet (square metres) and has a total gross floor area of 8,715 square feet. The guide price represents S$2,295 per square foot on the total gross floor area. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply