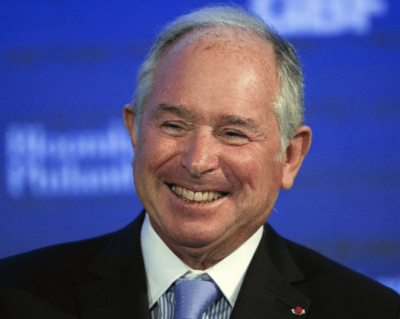

Stephen Schwarzman looks pleased with his fresh $100 million from Kprea Post

Blackstone has some fans in Korea, as one of the North Asian nation’s largest public pension funds has decided to invest $100 million with the US private equity giant’s real estate debt fund, according to Korean media reports. That story leads Mingtiandi’s headline roundup today, along with new of yet another mainland developer trying their luck at electric cars.

Also in the news, Hong Kong retail rents continue to slide, and the city’s streets are getting so unnerving that even the economic risks of Britain’s Brexit are beginning to look inviting to some investors from Asia’s wealthiest city. All these stories and more await you below.

Blackstone’s $100M Korea Post Check is in the Mail

Korea Post has awarded two real estate debt investment mandates worth $150 million to the Blackstone Group and Principal Asset Management, its savings unit said on July 4.

The state-run agency’s investment committee has recently decided to entrust $100 million to Blackstone’s blind-pool real estate debt fund and $50 million to Principal Asset’s to invest in mezzanine notes. Read more>>

R&F Group Enters Electric Car Market

China has another unlikely partnership between a real estate developer and an EV maker.

This time it’s Hawtai, a Chinese automaker with both traditional fossil fuel vehicles and new energy vehicles in its product lineup who formed a strategic cooperation agreement with R&F Group, one of the top 10 listed real estate developers in China, to collaborate in the new energy vehicle sector. Under this agreement, R&F Group will buy a stake in Hawtai, which is headquartered in Beijing, said the automaker on its website over the weekend, without revealing any further details. Read more>>

HK Landlords Offer Discounts as Central Retail Rents Drop 3.8%

Hong Kong’s retail leasing market is expected to slow further in the second half as sales continue to slump because of the US-China trade war and uncertainty over protests against the extradition bill, industry observers say.

Overall rent for shops along prime shopping streets fell 1.2 per cent quarter on quarter from April to June, with Central recording the sharpest drop at 3.8 per cent, real estate research and consultancy firm Savills said. Read more>>

Spooked by Protests, HK Investors Eye London Property

Hong Kong-based property investors are looking for safe havens in London after high-profile political protests at home.

Several West End and City agents told the Standard of higher enquiries from Hong Kong buyers for commercial property in the capital. The interest comes after widespread protests in the former British colony over a proposed bill permitting extraditions to mainland China. Read more>>

China Regulator Orders Trusts to Rein in Real Estate Financing

A Chinese financial regulator has ordered ten trust companies to ensure no growth in the outstanding amount of their real estate businesses at least until the end of the third quarter, as regulators worry about froth in the property market.

The China Banking and Issuance Regulatory Commission (CBIRC) summoned the trust companies to a meeting Wednesday where officials instructed the companies to get the scale and growth of their property financing businesses under control. Read more>>

US Footwear Company Calares to Open Stores in China

The footwear company said it will begin to distribute footwear in greater China, including Hong Kong, Macau and Taiwan, through a joint venture with Brand Investment Holding, a member of the Gemkell Group. The venture will kick off with Caleres’ Naturalizer and Sam Edelman brands, which will be marketed and sold across multiple channels, including branded retail stores and e-commerce sites.

This summer, the first Naturalizer store will open in Beijing and the first Sam Edelman store will be launched in Shanghai. Additional stores are planned for other markets, as the business expands. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply