Blackstone may be shopping for bargains at Anbang’s close-out sale

Alternative asset giant Blackstone leads today’s headline roundup with news of potential acquisitions in both Japan and India, as Mingtiandi helps you through the headlines.

In mainland China, the government’s ongoing clampdown on the housing industry continues to discourage developers, as new investment growth slowed to single digits in July. And in Singapore, private equity real estate shop Arch Capital has wrapped up one of its biggest deals in the Lion City. All these stories and more are in today’s news survey.

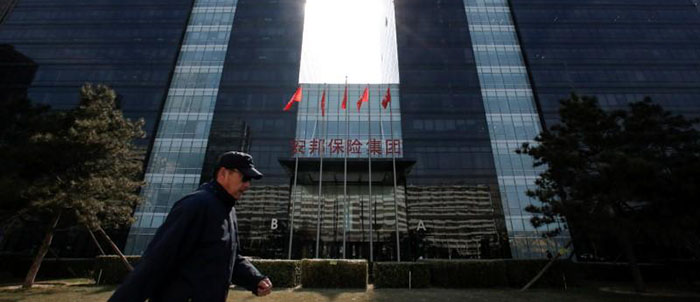

Blackstone Said Bidding for Anbang’s $2.4B Japan Portfolio

China’s troubled Anbang Insurance Group has put its $2.4 billion property portfolio in Japan up for sale and previous owner Blackstone Group (BX.N) is bidding, two people familiar with the company’s plans said.

The insurer is offering its entire portfolio of mainly residential buildings in Tokyo and other big cities after it failed to sell some of the assets last year, the sources said. A price has not been set as the sale is still in its early stages, they said. Anbang paid Blackstone about 260 billion yen ($2.4 billion) for the portfolio in 2017, then Japan’s biggest property deal since the global financial crisis. Read more>>

Blackstone to Buy India Tech Park From Coffee Day Estate for Up to $417M

A fortnight after the alleged suicide of Cafe Coffee Day founder VG Siddhartha, the coffeeshop brand’s holding company Coffee Day Enterprises Ltd. has decided to sell Global Village Tech Park held by Coffee Day subsidiary Tangling Developments Ltd. to US-based buyout giant Blackstone Group Llp for a price of ₹2600-3,000 crore ($361 million to $417 million), according to an exchange filing.

On 9 August Mint first reported that the CDEL board decided to sell the group’s 90-acre Global Village Tech Park in Bengaluru to reduce CDEL’s debt burden and Blackstone Group was one of the top contenders to buy the Global Village Tech Park. Read more>>

China Property Investment Growth Slows to 8.5%

China’s property investment slowed to its weakest pace this year in a sign the housing market’s resilience may be waning as Beijing toughens its crackdown on speculative investments and holds back on new stimulus.

Property investment in July rose 8.5% year-on-year, easing from June’s 10.1% gain and was the slowest since December’s 8.2%, Reuters calculation based on National Bureau of Statistics (NBS) data on Wednesday showed. It still grew 10.6% from the prior year for January-July, compared with a 10.2% increase in the same period last year and 10.9% in the first six months. Read more>>

China Monthly Home Price Growth Stays at 0.6% in July

China’s new home prices rose 0.6% month-on-month in July, in line with June’s growth and marking the 51st straight month of gains, Reuters calculated from official National Bureau of Statistics (NBS) data on Thursday.

On a year-on-year basis, average new home prices in China’s 70 major cities rose 9.7% in July, compared with a 10.3% gain in June. A slew of government curbs and a broader slowdown in the economy have weighed on the property market. Read more>>

Arch Capital Completes S$210M Purchase of Singapore’s Anson House

Hong Kong-based fund manager Arch Capital Management completed the acquisition of Anson House for S$210 million on Wednesday, in a deal which had been reported earlier by Mingtiandi.

The price for the fund manager’s purchase of the office building in the city’s Tanjong Pagar area works out to S$2,435 per square foot based on the 13-storey tower’s net lettable area (NLA) of 86,239 sq ft. The seller was a fund managed by Savills Investment Management. Read more>>

Prices for Singapore’s Second-Hand Homes Slide in July

Resale prices of condominium units in Singapore dipped again in July for the second consecutive month, while volume of sales surged by almost one-third, according to monthly figures from real estate portal SRX Property released on Wednesday.

Overall condo resale prices were down 0.5 per cent in July from the previous month. June had seen a 0.4 per cent decline from the peak in May, breaking an upward trend that had lasted four months. Read more>>

WeWork’s Tech Startup-Style Control May Test Investor Appetite

Investors in the upcoming initial public offering of WeWork’s parent, The We Company, are being asked to lower their standards for corporate governance beyond what other technology startups have demanded, securities law experts said on Wednesday.

Adam Neumann, the company’s CEO and co-founder, will control the company through his ownership of shares with high voting power, a common structure among newly listed Silicon Valley unicorns, including ride-sharing startup Lyft Inc, Snapchat owner Snap Inc and social media giant Facebook Inc. Read more>>

Hong Kong Retail Giant Hysan Says July Sales Fell Over 10%

Hysan Development, the biggest landlord in Hong Kong’s shopping district Causeway Bay, said that overall sales at its shopping centres is likely to have fallen by at least 10 per cent in July, as the regular extradition bill protests in the area kept shoppers away.

“For July … I believe a drop can be seen. The initial estimate will be in early teens, a drop of at least 10 per cent,” Roger Hao, Hysan’s chief financial officer, said after the firm reported an 8.9 per cent rise in an underlying profit to HK$1.39 billion (US$177.15 million) for first half, on Tuesday. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply