Hong Kong’s high rises are showing an elevated risk of a bubble says UBS

As if the possibility of getting tear gassed during a late night search for noodles isn’t enough, Hong Kong residents are now being warned by a Swiss bank that they need to worry about the value of their homes collapsing.

An annual study of housing markets by UBS has ranked the Asian financial hub as the third riskiest city for home buyers globally, as well as rating Hong Kong as the most unaffordable place to live in the world.

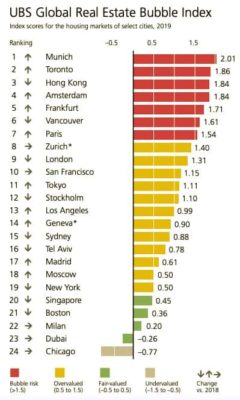

After naming Hong Kong as the most over-inflated housing market in the world last year, the 2019 edition of the UBS Global Real Estate Bubble Index, which tracks the risk of property price bubbles in 24 metros globally based on a selection of economic indicators, has identified Munich as the city at greatest risk of a bubble, with Hong Kong ranked third after second-placed Toronto.

Defining a price bubble as a “substantial and sustained mispricing of an asset, the existence of which cannot be proven unless it bursts”, the Swiss Bank compiles its index annually by measuring the weighted average of price-to-income and price-to-rent indices, as well as the change in mortgage-to-GDP and construction-to-GDP ratios.

The Bubble Index, which does not include mainland China, identified Singapore’s home prices as being fair-valued.

Hong Kong Most Unaffordable but Crash Unlikely

While noting that some of the froth has come off of Hong Kong’s market in the last year, the bank’s analysts still found that the city’s pricey homes carry a risk of sudden price collapse.

“In Hong Kong, momentum has abated and prices have fallen slightly since mid-2018,” the authors of the study noted. “Nevertheless, although the city is still in bubble-risk territory, given that prices have doubled over the last ten years, there is no fundamental trend reversal in sight.”

UBS Bubble Index rankings

The Swiss bank said that it expects prices to fall further after primary residential transactions dropped by about 40 percent over the summer, although indicating that a crash seemed unlikely.

Despite the slight price correction, Hong Kong retained its crown as the most unaffordable city globally, with Paris in second place, above London and Singapore.

According to the Swiss bank’s calculations, buying a 60 square metre (650 square foot) apartment in Hong Kong costs the equivalent of 21 years’ annual salary, compared with 15 years in Paris and 14 years in London.

UBS’ study ranks Hong Kong third behind Zurich and Munich in terms of its price-to-rent ratio, with a 650 square foot flat needing to be leased out for 37 years before it is fully paid off.

Singapore Property Market Stable

While continuing its title as the priciest property market in Southeast Asia, UBS ranked Singapore as twentieth out of the 24 cities studied in terms of its property bubble risk, categorising real estate in the city state as being “fair-valued.” That ranking showed little change from last year when the Lion City was ranked eighteenth out of twenty cities in the bank’s study.

Despite a brief housing boom between mid-2017 and mid-2018, UBS identified the additional buyer stamp duties (ABSD) for developers and purchasers of investment properties which Singapore introduced last year as having put a lid on rapid price growth.

“Real prices are basically on the same level as in 2012, such that the city remains in fair-valued territory,” the authors of the study noted.

Despite this market stability, the study ranks property in Singapore as the fourth most unaffordable in the world, with the cost of a 60 square metre apartment equivalent to 12 years’ annual salary.

The survey ranked Singapore as the fifth most costly in price-to-rent terms, with a 650 square foot flat taking 32 years to pay off.

The End of the Boom

With price growth rates slowing in the majority of the cities studied, average price growth globally has come to a standstill for the first time since 2012, according to UBS.

The authors of the Bubble Index noted that, although owning residential property in global cities has been a sure road to wealth accumulation in the past, real price appreciation can no longer be taken for granted, with prices outpacing incomes in recent years.

“Despite the worldwide collapse in interest rates, the negative trend in home prices will probably continue,” the authors said.

Leave a Reply