Vacancy climbed in Shanghai’s core commercial districts

Despite more space being leased in recent months, Grade A office rents in Shanghai continued their downward slide in the second quarter of 2020, according to recent reports by property agencies covering the city.

Following a lockdown that kept most businesses working at home during the first quarter, the amount of space leased in the city’s office market registered a net gain of 116,265 square metres (1.25 million square feet), a marked change from the 90,545 square metres (974,618 square foot) decrease in the first three months of this year, according to Cushman & Wakefield.

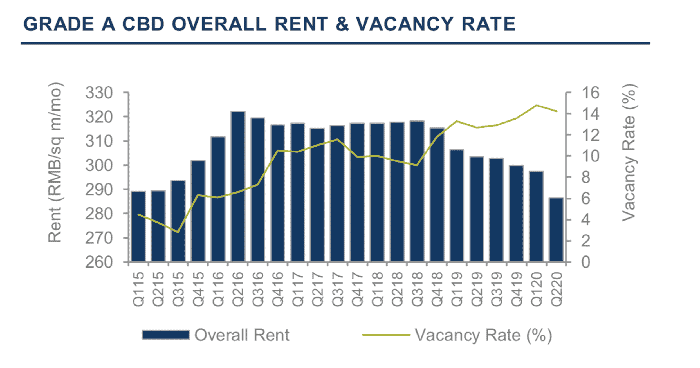

However, despite the increased activity, rental rates slid at a faster pace during the period, with Shanghai’s core commercial markets recording average rentals of RMB 286.4 ($41.03) per square metre per month during the period from April through June — down 3.7 percent compared to the previous three months, according to the C&W report.

Helping to push rents lower is a flood of new real estate projects being completed away from the city’s traditional commercial core, as well as bargain-hunting by tenants as lower-priced office options become available.

Service Sector Drives Rebound in Demand

Industry analysts attributed the uptick in leasing activity to cooperation between policy-makers and enterprises in the wake of the first quarter lockdown, with much of the space taken up located in emerging commercial centres.

James Macdonald, Head of Savills Research China

“Combined efforts from government and firms allowed Shanghai’s real estate market to gradually recover,” said Eddie Ng, Managing Director for JLL East China. “Office leasing resumed as the decentralized market saw more leasing and firms pursued cost-saving strategies”.

Cushman’s researchers found that 64 percent of the new space leased during the quarter was located in suburban areas, including significant deals in the Pudong neighbourhoods of Qiantan and Yangjing, as reform of China’s financial sector is seen sparking expansion plans by both local and international institutions.

“Pudong has a lot of financial tenants,” James Macdonald, head of research for China at Savills told Mingtiandi. “This sector is seeing international firms take more space as the market opens to overseas competition, also reforms are creating new opportunities for domestic businesses to grow such as the granting of securities to banks.”

Office leasing experts at JLL saw a similar trend, with service sector tenants picking up any slack left by a still recovering manufacturing sector.

“While the market remains under pressure from the outbreak, demand from firms in the TMT, healthcare, and financial services industries has remained resilient,” said Anny Zhang, Head of Markets for JLL China.

New Projects Add to Vacant Space

While tenants began re-entering the market, the service sector revival proved insufficient to overcome an increase in new supply, as the vacancy rate for grade A offices citywide rose half of a percentage point since the end of March to reach 17.4 percent, according to Savills.

Rents fell and vacancy rose in Q2 (Source: Cushman & Wakefield)

“Despite a temporary decrease in vacancy rates in the first quarter, they increased in the second quarter of 2020, due to new project completions and limited take-up,” Savill’s Macdonald said.

Two Grade A projects were completed in the period, EDGE by K.Wah International and One Financial Street Phase I by Hong Kong private equity firm Phoenix Property Investors, both in the section of Jing An district near Shanghai train station.

Together, the two developments brought a total of 78,429 square metres of new supply to the market, pushing the city’s total Grade A office stock to 12.8 million square metres.

Shanghai Office Supply to Grow by 50%

With vacancy climbing in Shanghai, both landlords and tenants appear to have an eye on the pipeline of future projects, with much of the leasing activity attributed to tenants looking for more affordable offices as landlords are offering longer rent-free periods, customised fit-out provisions and other incentives.

“Certain sectors and companies are still growing and thinking about long term opportunities with a growing number of tenants taking longer-term commitments at favourable rates,” Savills’ Macdonald said.

Those more tenant-friendly conditions could continue to accelerate as Savills predicts that over 784,000 square metres of new projects will enter the market this year. In its report, Cushman & Wakefield forecasts that over 6.4 million square metres of new office space will be added to the city over the next five years, increasing Shanghai’s venues for desk parking by 50 percent.

Leave a Reply