Large scale commercial property transactions in Shanghai increased by fifty percent from 2012 to 2013, according to one of the world’s largest real estate agencies.

The rise in en-bloc transactions, or sales of whole commercial buildings, reached RMB 46.7 billion (US$7.66 billion) in China’s commercial centre this year, largely due to an influx of foreign capital into the market, property services firm DTZ said in a recent report.

While the study only looked at deals of at least US$10 million in value, it found that fifty-four percent of these sales – involving 25. billion yuan of real estate – were to foreign buyers. The amount of foreign capital spent on acquiring Shanghai commercial properties was a 145 percent increase over the previous year, according to DTZ’s figures.

Foreign Funds Helping to Fuel the Market

The influx of foreign capital is not surprising considering the activity of regional and global investment funds in the Shanghai market this year.

In April this year US private equity giant Carlyle Group acquired the Central Plaza building in downtown Shanghai for US$266 million, and that same month, Hong Kong private equity firm Gaw Capital acquired the Cross Tower in Huangpu district for RMB 1.67 billion.

Since that time, KKR of the US has raised a US$6 billion fund that is looking for China real estate assets, while Hong Kong’s Gaw Capital raised $1 billion for the same purpose and rival Hong Kong firm RRJ Capital is planning to raise $1 billion more.

“Overseas investors seemed to regain their appetite for local properties this year while financial institutions were the most active among all domestic investors,” said Jim Yip, managing director of investment and advisory services, DTZ China in speaking to the Shanghai Daily.

Office Deals the Most Popular in 2013

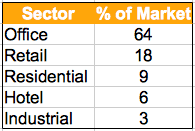

The study showed that purchases of office buildings were by the far the dominant form of en-bloc investment during 2013, reflecting both the perceived stability of the office sector, and the relative scarcity of quality assets in other market segments.

The study showed that purchases of office buildings were by the far the dominant form of en-bloc investment during 2013, reflecting both the perceived stability of the office sector, and the relative scarcity of quality assets in other market segments.

The adjacent table breaks down the market value of 2013 en-bloc real estate investment deals as a percentage of the total market investment.

Real Estate Agency Says Next Year Will Be Even Better

For the year ahead, investment prospects for real estate projects in Shanghai will remain rosy with overseas and domestic companies continuing to be active, according to DTZ’s forecast.

In his interview with the Daily, DTZ’s Yip foresaw the office sector as continuing to hold the greatest promise next year. “Offices will continue to be chased after with those in the Pudong New Area particularly attractive to investors mainly due to the recent opening of free trade zone,” Yip said.

We can expect similar reports on the investment climate from DTZ’s competitors in the coming weeks, and Mingtiandi will be sure to cover them so that you can see how each firm’s assessment of the market compares.

Leave a Reply