Year on year sales growth rate for China’s overall real estate industry

China appears to have avoided a meltdown in its real estate market this year, but home sales are continuing to slide, according to official figures released this week.

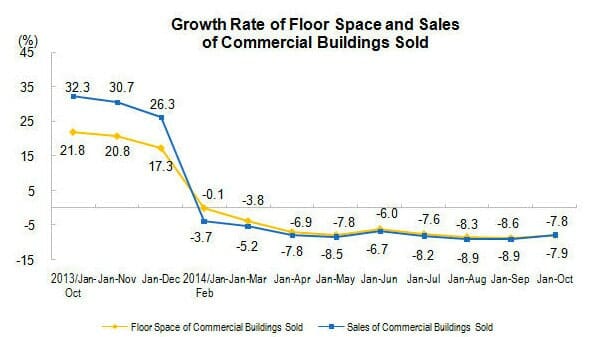

In a report released this week, China’s National Bureau of Statistics revealed that sales of new homes were down 9.9 percent nationwide in the first 10 months of 2014, compared to the value of housing sold during the same period last year.

The new figures for the year to date mean that sales for the month of October fell by 3.1 percent in Renminbi terms, an improvement over the 10.3 percent annualised drop in sales recorded in September, but not yet the recovery that many real estate investors had hoped for.

In terms of floor space, sales were down 9.5 percent during the first ten months of the year, showing that developers are continuing to discount in order to sell new homes.

The latest figures indicate that buyers remain unconvinced of the possibility of a quick turnaround in China’s housing market, and are taken by Mingtiandi to mean that the current slump will extend well into 2015.

Sales Slide Continues Despite Govt Moves

The slowdown in China’s homes sales slide is likely attributable to government moves to ease credit for homebuyers and roll back mortgage restrictions during September.

Just before China’s National Day holiday at the beginning of October the government reacted to several months of falling home prices and slowing sales by expanding the pool of homebuyers eligible for mortgage financing and lowering downpayment requirements in some cases.

Considering that October is traditionally one of China’s strongest months for real estate sales, the tepid response to these concessions means that the nation’s homebuyers may not yet be convinced that home values are on their way back up.

Credit agency Moody’s seemed to back up the buyer sentiment this week when it re-confirmed its negative outlook on the industry’s credit and projected a potential five percent further drop in home sales next year accompanied by a continued slide in pricing.

Real Estate Slowdown Taking a Toll on the Economy

Growth rate in China’s real estate investment in 2015

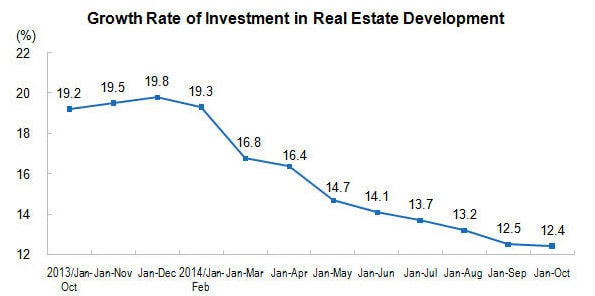

The slowdown in home sales seems to have discouraged the real estate development industry as growth in investment by residential developers rose by only 11.1 percent in the first 10 months of the year.

The figures for the period through October showed a 0.2 percent annual slowdown compared to the results for the period through September. The growing reluctance by developers to invest in developing new projects holds the promise of eventually reducing current unsold inventories of new homes, but also mean a continued drag on an economy which has traditionally relied on the real estate sector for an estimated 15 percent of its GDP.

Unfortunately for China’s developers who are fighting to sell that backlog of unwanted apartments and villas, the floor space of housing under construction was still up 8.8 percent during the first 10 months of the year, although new construction starts were down 9.8 percent during the period.

Prices Should Continue to Come Down as Backlog Builds

While the recent government measures appear to have reached their goal of preventing a freefall in China’s real estate market, from these latest statistics, the market does not appear ready for recovery just yet.

It is Mingtiandi’s prediction that average home prices should continue to fall another five percent nationwide between now and the middle of next year, and sales will not improve substantially until after China’s spring festival holiday in late February at the earliest.

Leave a Reply