2015 investment prospects for APAC cities according to the ULI

When China’s home team of investors prefers to hit the road rather than take on real estate projects domestically, then it may come as no surprise that a regional survey of property professionals shows most Chinese cities falling from favor globally.

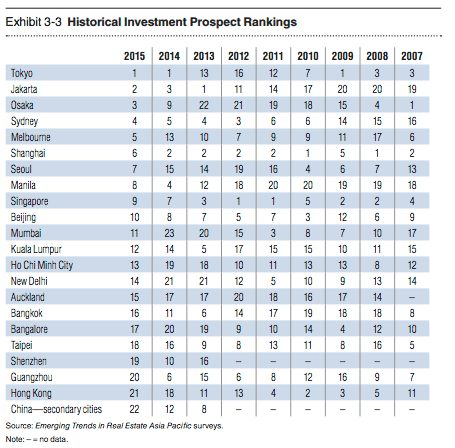

In a forecast of Asia Pacific real estate markets jointly published on Thursday by the Urban Land Institute and PwC, for the second year in a row, respondents voted Tokyo as the city with the best prospects for real estate development and investment in 2015. Shanghai – the top ranked mainland city – meanwhile fell to number six in the rankings of investment destinations after placing second for the four previous years.

Beijing, which placed tenth, was the only other mainland city to place in the top ten, as investors have begun prioritising locations outside of China for their new projects and acquisitions.

China Suffering From Too Much Competition for Real Estate Opportunities

The authors of the report, “Emerging Trends in Real Estate® Asia Pacific 2015,” found that China was perhaps suffering from too much investor attention for too long of a time, just as the nation’s economy has been grappling with a slowdown.

“Whether derived from new sources of institutional capital, or from almost six years of global central bank easing, a seemingly endless stream of money is now pointed at real estate assets across virtually all jurisdictions and asset classes. This is pushing up prices and further compressing yields,” noted ULI North Asia Chairman Raymond Chow.

Chow, who in his day job is an executive director of Hongkong Land Limited, tied this crush into the China market to a decline in investment prospects, noting that, “As a result, we are seeing fewer transactions (in China), a growing shortage of investment-grade properties, a search for alternatives to core products, and a general pullback from assets in secondary locations.”

The report analysed the results of a survey of 385 real estate professionals, including investors, developers, property company representatives, lenders, brokers and consultants.

Tokyo Stays on Top for Property

Japan’s capital continued to be the favorite among the survey respondents both for investment and for new development projects, thanks to the Abe government’s economic stimulus program.

Historical rankings of investment prospects in APAC cities by the survey

The authors also believed that Tokyo, which up until last year had not ranked in the survey’s top ten since 2010, still has some capacity to stay at the top. The report pointed to a new round of quantitative easing in October, as well as strong investment yields as supporting the city’s ongoing appeal.

And Tokyo was not the only Japanese city to find favor, with Osaka coming in third on the list after finishing only 9th last year.

Shanghai Among Few Favored Mainland Locations

China, however, was not viewed as favorably by the survey’s respondents this year, with rising asset values and declining rentals cited among the factors working against mainland cities as preferred investment destinations.

As pointed out in the report, “…many of China’s largest developers are now seeking foreign alternatives to their domestic programs, as development returns in China shrink and local operating conditions deteriorate.”

With local developers facing such conditions, the lack of interest from international players is not surprising. However, much of that negativity seems centred on China’s lower tier cities.

While falling four places in the investment rankings from last year, Shanghai still was among the most favored locations among respondents, and also finished seventh among preferred locations for new development projects.

Among the factors working in Shanghai’s favor, the report cited the city’s status as one of six or eight key gateway cities in Asia, which should ensure it a place among the target locations for international investment funds. Also working in favor of China’s commercial capital was what the survey termed a deep pool of investment-grade product, a stronger economy and greater transparency than other mainland cities.

China’s Second-Tier Cities Slide Down the List

While Beijing still received favorable attention, it’s clear that most of China’s other cities have fallen in favor among the real estate community.

China’s other two first-tier cities fell precipitously this year with Guangzhou dropping from sixth to 20th for investment prospects and Shenzhen declining from tenth to 19th.

The survey lumped China’s other cities together into one big cluster which fell from 12th for investment potential last year to 22nd – dead last on the list.

The survey cited oversupply of new projects as a major reason for downgrading cities such as Shenyang, Tianjin and Chengdu. An oversupply that may have resulted in part from an investor enthusiasm that ranked these same locations above regional hubs such as Tokyo, Osaka and Mumbai just two years ago.

Leave a Reply