Cushman & Wakefield’s Hong Kong team lined up to announce some record declines

Hong Kong office rents dropped for a sixth consecutive quarter in the three months ending 30 September, falling by 4.7 percent from June with analysts predicting that the average cost of leasing desk space in the city will have dropped by up to 21 percent by the end of the year.

The fall in leasing rates comes as office vacancy in Asia’s priciest city climbed to the highest level since 2005 during the third quarter. The level of empty desk accommodation reached an average of 11.6 percent citywide during the period, as tenants look to cut costs and the COVID-19 crisis triggers a work from home trend that has emptied many corporate workplaces, according to a recent report from Cushman & Wakefield.

“One of the key findings from our 2020 Office Occupier Survey, 65 percent of respondents are planning to allow working from home on a long-term basis,” said the property consultancy’s managing director for Hong Kong, John Siu.

The average cost of leasing a square foot of grade A office space in Hong Kong stood at HK$62.5 ($8) per month at the end of September, according to C&W’s analysis – down 13.9 percent from the beginning of 2020 and having fallen 16.1 percent over the past 12 months.

Tenants Staying Away

The decline in rents is being driven by a record setting drop-off in leasing, with net absorption of office space having fallen by 633,000 square feet (58,807 square metres) during the period from July through September – the biggest quarterly drop ever, according to the report.

Source: Cushman & Wakefield

With take-up of space having declined by 1.7 million square feet this year, a key factor has been tenants’ eagerness to hand back offices to landlords as COVID-19 adds to the problems of an economy which has been struggling since early 2019.

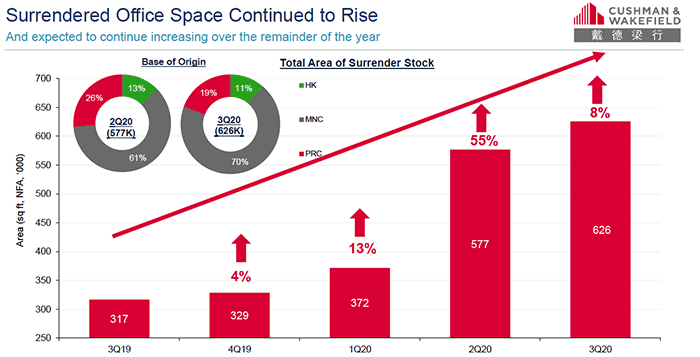

Occupiers have now surrendered 626,000 square feet of space to building owners – an increase of 8 percent since the end of June – as companies shed fixed costs and unload office space unneeded as headcounts are trimmed.

“Of the total, 70 percent space was surrendered by multinational corporations. This upward trend is expected to continue for the remainder of 2020,” said Keith Hemshall, Cushman & Wakefield’s head of office services for Hong Kong. The veteran broker pointed out, however, that some tenants have been taking advantage of the market downturn to relocate to higher grade addresses or move to nearby buildings at lower rates.

Central Hit Hard

The drop in Hong Kong’s leasing rates was most severe in the Greater Central area where prices fell by 6.7 percent last quarter to HK$126.5 per square foot. That performance brought the year to date rental decline in the city’s most expensive business district to 16.9 percent.

Close by in Wanchai and Causeway Bay rents dropped by 5.2 percent since the end of June to settle at HK$62.5 per square foot, the agency’s charts show. That slide brought rents in the Hong Kong island districts down by a total of 15 percent so far in 2020.

According to Cushman & Wakefield, the leasing market is expected to remain weak through the end of 2020, with office rentals in Greater Central forecast to drop by as much as 25 percent for the full year. In Wanchai and Causeway Bay the decline is expected to total 23 percent by 31 December.

City-wide, Cushman & Wakefield expects rents for grade A offices to have declined by from 16 to 21 percent for the full year of 2020.

Pandemic Adds to Pessimism

With Hong Kong facing 11 new Covid-19 cases on Wednesday, the government is weighing citywide shutdowns of pubs and bars and government office workers may begin to work at home again as the threat of fourth virus wave looms.

This uncertainty could add to the market’s current challenges, however, Cushman & Wakefield does not expect the work from home wave to detract from the long-term durability of demand for office space in Asia’s biggest financial hub

“While that’s certain to alter the office leasing landscape, we do not necessarily see it having a major impact on office demand in the long run,” said C&W’s Siu. “It is likely that much of the work from home will be part-time, perhaps one to two days a week.”

Leave a Reply