A Hong Kong family shares dinner in one of the city’s famously tiny apartments

Hong Kong is famous for its status as a financial hub and for the industriousness of its people, but now the southern Chinese city has achieved a new distinction – for having the world’s least affordable housing.

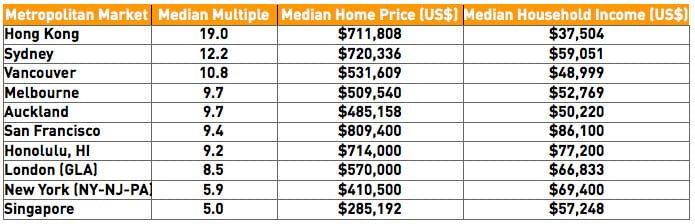

According to a survey released yesterday, the average Hong Kong household needs to save the equivalent of nineteen years worth of income to afford a median-priced home in the crowded city. This rate of unaffordability is nearly four times that of Singapore and the city is more than 50 percent more unaffordable than the second-least affordable city in the survey – Sydney, Australia.

Although home prices in Hong Kong began falling late in 2015, housing in the city has gone up in cost by more than 150 percent over the last seven years.

Land Use Restrictions Help Drive Up Hong Kong Prices

The study of housing unaffordability by independent consultancy Demographia is in its 12th year now, and Hong Kong’s ratio of median housing price to median household income was the highest ever, with the city now having led the survey’s index of housing unhappiness for five straight years.

The survey noted that Hong Kong’s housing affordability was much better in the early 2000s, with The Chinese University of Hong Kong documenting that from 2002 to 2014 the ratio of housing prices to income has risen approximately 275 percent in the city.

Source: Demographia International Housing Affordability Survey: 2016

The high cost of housing has made tiny apartments the only alternative even for many relatively well-to-do people with newly built studio flats as small as 16 square metres (177 square feet) selling for around HK$1.5 million ($192,000) in good locations in Hong Kong.

Research by scholars at the University of Missouri and other academic sources has attributed China’s high costs of housing and other real estate to the government tightly controlling the supply of new land offered for development, so that as much as 84 percent of the land in the Special Administrative Region remains undeveloped.

ANZ and Canada Fill Out the Top Five for Misery

Filling out the top five most unaffordable metropolitan areas covered in the survey were Sydney, where a median-priced home costs 12.2 times the median income; Vancouver, British Columbia, where an average house will set you back 10.8 times an average salary; and then Melbourne, Australia and Auckland, New Zealand, where a home in either city will set you back 9.7 years of income on average.

San Francisco, which landed sixth on the list, was the most unaffordable city in the US, with a median-priced home there going for 9.4 times a media salary. The survey treated New York as part of a tri-state metro area, which may have helped to bring down the median prices in the famously unaffordable US commercial centre.

Singapore, where home prices have fallen in the last year, had median housing costs of just five times a median income.

Mainlanders Right Up There for Unaffordability

Map of China housing “agony” shows years of work necessary to save up a down payment

While the Demographia study did not collect data on mainland locations, previous research has shown that the level of housing misery in several Chinese cities is on a par with the most unaffordable locations in the world.

In 2014 maps of housing misery in China went viral on the country’s Weibo micro-blogging network, with a down-payment on an average sized (80 square metre) home in Beijing, which was then the country’s least affordable city, costing the equivalent of 13 years of salary for an average worker.

Based on data from China’s National Bureau of Statistics, in all there were seven mainland cities, including Shanghai, Shenzhen, Hangzhou, Xiamen, and Nanjing, where homes were priced so high that buyers would need to save 100 percent of their earnings for at least nine years to cover the down payment for an 80 square metre home.

Leave a Reply