China’s housing prices slid for the fourth straight month in August as potential buyers continued to wait for lower prices despite removal of home purchase restrictions in many cities. According to new numbers released today by the National Bureau of Statistics, Hangzhou continues to be the epicentre for China’s real estate slide, with average home prices dropping in the capital of Zhejiang province by 2.1 percent in August compared to July.

Among the 70 cities that the government survey includes in its sample, home prices declined by an average 1.1 percent in August. August’s downturn in real estate prices marked a decided downward acceleration from July’s 0.9 percent slowdown.

So far this year sales of new homes have declined 11 percent — helping to keep downward pressure on home prices as more supply enters the market.

Compared to August last year, prices last month were down in 19 of the cities surveyed, and another 3 cities remain even with 2013 levels, when the market was booming.

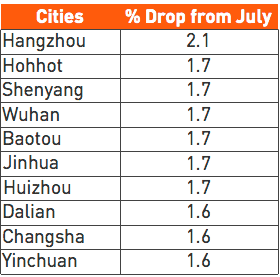

Hangzhou Leads China’s Top Ten Real Estate Losers

While Hangzhou led the downward movement, it had plenty of company, with a total of 68 out of 70 cities surveyed reporting falling prices. Out of the leading cities included in the survey, only Xiamen reported an increase in prices – of 0.2 percent. Wenzhou, which has long been the poster child for China’s real estate slide, notably stopped a more than two year decline in housing prices by holding steady in August, compared to July.

After Hanghzou on the list, the Inner Mongolian cities of Hohhot and Baotou, Shenyang, Wuhan, Jinhua (in Zhejiang), and Huizhou in Guangdong all recorded a slide of 1.7 percent. Dalian, Changsha and Yinchuan (in Ningxia) rounded out the top ten losers in China’s housing market, by all recording 1.6 drops in housing prices.

Among China’s largest cities, Shanghai and Guangzhou prices slid by 1.3 percent, Beijing was off of last month’s rates by 1.2 percent, and Shenzhen fell by 1.1 percent.

August Prices Slide Despite Removal of Purchase Restrictions

The acceleration in China’s housing downturn in August is perhaps most significant in that it happened despite major reversals in policy in many of the cities surveyed.

Out of the more than 30 cities that put home purchase restrictions in place to cool down the market during 2011, nine of them rolled back those rules during July, and another 15 made similar announcements in August.

In all, more than 80 percent of the cities that once restricted home sales are now said to have lifted these price control measures this year. Now that changes in regulatory policy have proved futile, the government is said to be planning to loosen rules on mortgage lending to encourage more buying.

China’s real estate sector is estimated to account for 20-25 percent of GDP, and the government will be careful to keep this economic engine going as it struggles to reach its target of 7.5 percent GDP growth for the year.

Government Findings Correlate with Private Market Studies

Today’s announcement by the Bureau of Statistics appears to roughly correlate with reports released earlier by private market research organizations.

A report published by the China Real Estate Index System (CREIS) on the last day of August found that average home prices declined by 0.6 percent across China last month, and rival information provider China Index Academy found a similar trend with average prices falling 0.59 percent across the cities surveyed.

For the Academy this was also a slight moderation of the rate of decline compared to July, when prices fell by 0.81 percent in the company’s survey.

Leave a Reply